- HOME

- About Us

- Corporate Governance

- Basic Policy on Corporate Governance

Basic Policy on Corporate Governance

Ⅰ. Basic Policy on Corporate Governance

1. Current System

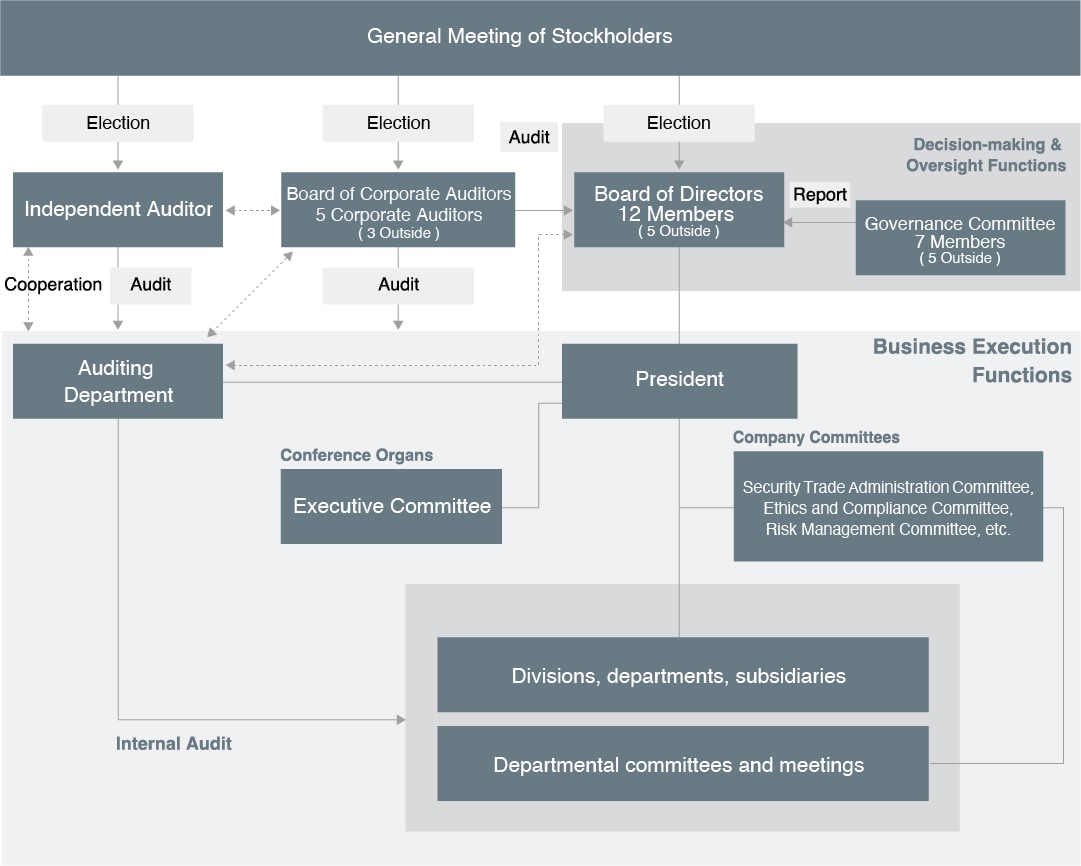

Toray is a company with Board of Corporate Auditors, and the members of the Board and corporate auditors are elected at the general meeting of shareholders. A summary of the system is illustrated in the figure <Corporate Governance Structures>.

Members of the Board and corporate auditors, as officers directly elected at the general meeting of shareholders, clearly recognize fiduciary responsibility to shareholders who have entrusted the management and appropriately fulfill their respective roles while discharging accountability about management status to shareholders and other stakeholders.

As Toray Group supplies a wide range of industries with basic materials and globally plays an active part in a broad scope of business fields, it is necessary to evaluate various risks multilaterally based on expertise relevant to the worksites, not only for management judgment and decision-making but also for oversight. To that end, the Board of Directors formulates a structure in which members of the Board familiar with the Toray Group businesses oversee management and make decisions from various viewpoints. Furthermore, the Board of Corporate Auditors audits the execution of operations by the members of the Board based on professional knowledge in fields such as finance, accounting and law in addition to an understanding about businesses, from a standpoint entirely independent of the Board of Directors as a system to secure transparency and fairness of oversight and decision-making.

Corporate Governance Structures

2. Members of the Board and the Board of Directors

- (1) Roles of the Board of Directors

The Board of Directors oversees management and makes decisions on important managerial matters toward the sustainable growth and increased corporate value of Toray Group for the mid- to long-term. - (2) Structure of the Board of Directors

Toray Group globally plays an active part in a broad scope of business fields and should appropriately respond to various risks surrounding each business in order to realize sustainable growth and increase corporate value. The Board of Directors has to evaluate the risks multilaterally to fulfill its roles of oversight and decision-making. To that end, the Board of Directors strives for appropriate balance in the number of members and structure, with members who widely cover the fields of the corporate activities of the Group in terms of knowledge, experience and ability. Additionally, the Board of Directors considers laws, important guidelines and rules, as well as diversity aspects such as gender, International experience, work experience and age, and appropriately ensures diversity as a whole. - (3) Delegation of decision-making authority

The Board of Directors establishes the Authority of Top Management, an internal rule that expressly stipulates important matters with respect to which decision-making authority is reserved by the Board of Directors and matters with respect to which decision-making is delegated to the management, including the President.

For matters with respect to which decision-making authority is reserved by the Board of Directors, a specific guideline for importance is established based on the degree of impact on the Company’s financial status and other factors, in order to ensure that the business operation of the whole of the Toray Group, including Group companies, is included appropriately according to importance, in addition to the matters set forth in laws and regulations. - (4) Committee assisting the Board of Directors

Toray establishes the Governance Committee as an advisory organ to the Board of Directors in order to report to the Board of Directors on important issues regarding the Company’s corporate governance over the mid- to long-term. The Governance Committee consists of chairman of the Board, President, and all of outside directors, and an outside director serves as a chairperson. Deliberation at the Governance Committee encompasses matters regarding the Company’s overall corporate governance matters, including the following.

- Structure of the Board of Directors

- Evaluation of the management and operation of the Board of Directors

- Policy on nominating candidates for members of the Board

- Remuneration system for members of the Board and corporate auditors

- Basic policy on electing and dismissing members of the senior management*, including the President

- "Members of the senior management" refer to representative members of the Board.

- (5) Procedures for nominating and dismissing candidates for members of the Board and electing and dismissing members of the senior management

- Nomination criteria of candidates for members of the Board

-

Internal members of the Board

As Toray Group supplies a wide range of industries with basic materials, when nominating candidates for internal members of the Board, the Company considers the candidate’s familiarity with its business and major functions, ability to make timely and appropriate management judgments based on rich experience at the worksites and deep expertise, as well as management track record and experience at Toray Group. The nomination criteria also include an ability to oversee management based on fiduciary responsibilities from an objective standpoint independently of business operations. -

Outside directors

For outside directors, the criteria for nominating candidates are an ability to oversee management from broader perspectives to further improve the transparency and fairness of management and an ability to provide appropriate advice to the management from a mid- to long-term perspective, based on sympathy with the Toray Philosophy and a profound understanding of the basic materials business.

-

Internal members of the Board

- Procedures for nominating candidates for members of the Board

The nomination of candidates for members of the Board goes through the following process: discussions among the senior management, including the President; confirmation of candidate selection policies by the Governance Committee; confirmation of mid- to long-term succession plans for key positions; and multifaceted deliberation on individual nomination proposals. The nomination of candidates is then approved by the Board of Directors. - Election and dismissal of the President

After considering the candidate’s management track record and experience at Toray Group, the President is elected based on the candidate’s rich experience at the worksites and deep expertise, as well as insights and other qualities that serve to embody the Toray Philosophy globally. The election and dismissal of the President is approved by the Board of Directors after deliberation by the Governance Committee. - Procedures for dismissing members of the Board

The dismissal of members of the Board follows the provisions of the Companies Act through deliberations at the Governance Committee. - Independence of outside directors

The standards for the independence of outside directors are established as shown in <Standards for Judging the Independence of Outside Directors/Corporate Auditors>.

- Nomination criteria of candidates for members of the Board

- (6) Succession plans for the President and other members of the senior management

For appointing future Presidents and other members of the senior management from within the Company, it is important to systematically train and nurture candidates in advance by, for example, appointing them in key positions in consideration of their potential to serve senior management positions. Mid- to long-term succession plans for key positions are periodically created and approved by the Board of Directors following the deliberation by the Governance Committee. - (7) Remuneration for members of the Board

- Basic policy

To lead to improvements in the Toray Group’s mid- to long-term corporate value and sustainable growth, Toray has established a remuneration system for members of the Board. With respect to the Decision-making Policy for the remuneration system for members of the Board, in addition to matters stipulated by laws and regulations, the decision-making rights on important matters are reserved by the Board of Directors based on the Authority of Top Management. Particulars of the agenda regarding remuneration for members of the Board at the general meeting of stockholders, and the formulation and revision of important internal regulations, as well as individual remuneration to members of the Board, are determined by resolution of the Board of Directors. The remuneration system for members of the Board is continually reviewed by the Governance Committee. - Composition and level of remuneration

Given their roles, remuneration for internal members of the Board consists of basic remuneration which is a fixed amount, as well as a performance-based remuneration, including bonus which takes into account the consolidated business results for each fiscal year, etc., and restricted stock remuneration, which are linked to medium- to long-term business results. Given their roles, remuneration for outside directors consists of basic remuneration only. The Company will aim to set remuneration at a level that enables it to secure outstanding talent and enhance motivation for improved performance, referring to the results of a survey of other companies’ remuneration for members of the Board by an external third-party organization. The ratio between performance-linked and non-performance-linked remuneration will be adjusted, referencing the same third-party surveys and reviews by the Governance Committee, to enhance incentive effects. Through these efforts, the Company will aim to establish a well-balanced remuneration structure, comprising basic remuneration, bonuses, and restricted stock remuneration that supports management from a medium- to long-term perspective. - Basic remuneration

With respect to basic remuneration, the maximum limit of total remuneration is determined at general meetings of stockholders as a total amount of basic remuneration and bonuses. Particulars of the agenda at the general meeting of stockholders are determined by the Board of Directors following a report from the Governance Committee. Within the scope of the maximum limit, basic remuneration to each member of the Board is determined by the Board of Directors after the Governance Committee makes a report to the Board of Directors. Basic remuneration consists of monthly remuneration of a fixed amount. - Bonuses

Bonuses will be paid to internal members of the Board based on the Company’s performance for each fiscal year. The maximum total amount for basic remuneration and bonuses will be determined by resolution at the general meeting of stockholders. The Proposition to be submitted to the general meeting will be determined by resolution of the Board of Directors, based on a report from the Governance Committee. Whether to pay bonuses and the total amount thereof for each fiscal year will be determined by resolution of the Board of Directors, based on a report from the Governance Committee, considering of consolidated core operating income, which best reflects the results of the Company’s global operations, and with a view to strengthening performance incentives by increasing the proportion of bonuses within the total remuneration. Bonuses for individual internal members of the Board will be evaluated based on indicators such as consolidated core operating income, budget achievement of their responsible divisions, progress on medium-term management issues, and engagement with individual challenges, and will be determined by resolution of the Board of Directors, based on a report from the Governance Committee. Bonuses are to be paid at a certain time every year. - Restricted stock remuneration

To incentivize internal members of the Board to strive for sustainable enhancement of corporate value and to promote further value sharing with stockholders, the Company will grant restricted stock remuneration to internal members of the Board. The maximum total amount of remuneration and the maximum number of restricted shares to be allocated to internal members of the Board will be determined by resolution at the general meeting of stockholders. Particulars of the agenda at the general meeting of stockholders are determined by the Board of Directors following a report from the Governance Committee. Within that limit, the total number of restricted shares to be allocated to each internal member of the Board shall be determined at the Board of Directors meeting based on the standards determined by the Board of Directors after the Governance Committee makes a report to the Board of Directors. A base amount of remuneration for each internal member of the Board that is used for calculation shall be determined at the Board of Directors meeting after the Governance Committee makes a report to the Board of Directors. Restricted stock remuneration is granted at a certain time every year. - Others

At the 130th Ordinary General Meeting of Stockholders, the payment of retirement allowances to members of the Board for termination resulting from the abolition of the retirement allowance program for members of the Board was resolved. It was also resolved that retirement allowances were to be paid to internal members of the Board in office at the close of the said general meeting for the services they rendered up to the close of the said general meeting. The retirement allowance to be paid to each internal member of the Board is determined based on a resolution at a Board of Directors meeting after the 130th Ordinary General Meeting of Stockholders. The retirement allowance is paid at the time of retirement of each internal member of the Board.

- Basic policy

- (8) Related party transactions

With respect to any transaction between a member of the Board and the Company that involves a conflict of interest, the Board of Directors stipulates internal procedures therefor pursuant to laws and regulations and administers them appropriately so as not to damage the interests of the Company or common interests of shareholders. If a stockholder holds 10% or more of the Company’s stock and engages in a transaction with the Company, the Board of Directors will take appropriate procedures and appropriately administer the transaction. - (9) Measures for the effective function of the Board of Directors

- A. Training for members of the Board

Toray provides members of the Board with training opportunities so that they can acquire knowledge necessary for their duties and appropriately fulfill their roles.

Specifically, the Company holds internal training sessions for the members of the Board and encourages them to participate in seminars and training outside the Company.

As outside directors significantly vary in their fields of specialization and degree of experience in corporate management, the Company individually handles them mainly in light of their individual backgrounds. - B. System for assisting outside directors

- Toray designates a department in charge of assisting the execution of duties by outside directors.

- When convening Board of Directors meetings, the Company provides its outside directors with timely and appropriate information by sending materials relating to agenda items prior to each meeting of Board of Directors.

- Toray formulates an annual schedule for Board of Directors meetings in advance and pays the utmost attention to enable the attendance of outside directors.

- If an outside director intends to hold meetings with other outside directors or outside corporate auditors, etc. separate from the Board of Directors meeting, the abovementioned department shall provide required assistance in cooperation with the relevant departments.

- C. Evaluation of effectiveness of the Board of Directors

Each year the Board of Directors analyzes and evaluates whether the Board of Directors effectively functions and appropriately fulfills its roles, mainly based on a self-evaluation by each member of the Board and the evaluation by corporate auditors.

The Board of Directors strives to improve its operations, etc. based on the results of its evaluations.

3. Corporate Auditors and the Board of Corporate Auditors

- (1) Roles of the corporate auditors and the Board of Corporate Auditors

Corporate auditors and the Board of Corporate Auditors audit the execution of duties by members of the Board and implement other matters set forth in laws and regulations, etc. from a standpoint entirely independent of the Board of Directors, and strive to establish an effective governance structure through their activities.

Corporate auditors and the Board of Corporate Auditors cooperate with an independent auditor to perform appropriate audits, and select and evaluate an independent auditor based on an appropriate standard. - (2) Structure of the Board of Corporate Auditors

Not less than half of the corporate auditors shall be composed of outside corporate auditors. In addition, at least one person who has appropriate expertise on finance and accounting shall be appointed as corporate auditor. - (3) Nomination of candidates for corporate auditors

For corporate auditors, the main criterion for nominating them is an ability to appropriately carry out their roles while keeping objectivity and neutrality, either from a viewpoint with profound knowledge of Toray Group businesses in the case of internal corporate auditors or from a professional viewpoint in the case of outside corporate auditors.

With the consent of the Board of Corporate Auditors, the Board of Directors approves the nomination of candidates for corporate auditors, who meet the abovementioned criterion, have superior character and knowledge, and are judged to be appropriate as corporate auditors.

The standards for the independence of outside corporate auditors are established as shown in <Standards for Judging the Independence of Outside Directors/Corporate Auditors>. - (4) Remuneration for corporate auditors

Given their roles, remuneration for corporate auditors consists of monthly remuneration only.

Remuneration is set at a level that enables the Company to secure superior human resources, referring to the results of a survey of other companies’ remuneration by an external third-party organization.

With respect to monthly remuneration, the maximum limit of total remuneration is determined at general meetings of shareholders. Within the scope of the maximum limit, monthly remuneration to each corporate auditor is determined through consultation by corporate auditors based on the Company’s internal regulations. - (5) Training for corporate auditors

Toray provides corporate auditors with training opportunities so that they can acquire knowledge necessary for their duties and appropriately fulfill their roles.

Specifically, the Company holds internal training sessions for corporate auditors and encourages them to participate in seminars and training outside the Company.

As outside corporate auditors significantly vary in their fields of specialization and degree of experience in corporate management, the Company individually handles them mainly in light of their individual backgrounds.

4. Relationship with Stakeholders including Shareholders

- (1) Responsibility to stakeholders including shareholders

Toray recognizes that corporate activities are supported by cooperation with various stakeholders and places great importance, from a managerial standpoint, on appropriately returning its fruits to stakeholders and thereby creating a long-term relationship of trust with stakeholders. - (2) Securing the rights of shareholders

To substantially secure shareholders’ rights, the Company takes necessary steps pursuant to laws and regulations and develops an appropriate environment. Especially, the Company pays due attention to ensure that foreign shareholders and minority shareholders will not be treated disadvantageously without reasonable cause upon exercising their rights. - (3) General meeting of shareholders

Toray develops circumstances under which shareholders can appropriately exercise their voting rights at the general meeting of shareholders.

The Company sincerely accepts the results of voting rights exercised for or against proposals at the general meeting of shareholders at all times, and when a considerable number of votes are cast against a Company proposal, the Board of Directors takes necessary measures after analyzing their causes. - (4) Strategic holdings

To lead to improvements in the Toray Group’s mid- to long-term corporate value and sustainable growth, the Company holds the shares of business partners, in comprehensive consideration of purposes including strengthening of transaction relations, smoothing business alliances, and reinforcing joint research and technology development, as well as business strategies.

For such individual strategic holdings, the Company periodically reviews the purposes and reasons for holding shares at the Board of Directors meetings from both quantitative perspectives of whether the benefits and risks associated with each holding are worth the Company’s capital cost and qualitative perspectives such as compatibility with the purpose of holding, and sells shares that have become less meaningful to hold primarily due to changes in transaction relations.

When exercising the voting rights as to the strategic holdings, the Company decides to approve or disapprove each agenda based on its conviction that the mid- to long-term improvement of the corporate value of business partners will also lead to the enhancement of Toray Group’s corporate value.

When shareholders who hold the Company’s shares indicate their intention to sell their shares, the Company will respect their intention and respond appropriately. - (5) Dialogue with shareholders

Toray positions the sharing of its basic policy of managing the Company from a mid- to long-term perspective with more shareholders and the promotion of the continuous holding of Company shares over the mid- to long-term as important managerial issues.

To that end, from the viewpoint that secured management transparency should serve as a basis for dialogue with shareholders, the Company established the Information Disclosure Principles as shown in <Information Disclosure Principles> to improve the structure of its system for appropriate and timely information disclosure.

For shareholders and investors with which the Company strives for constructive dialogue from a mid- to long-term perspective, the senior management will respond to them within a reasonable range and otherwise will work on constructive dialogue for both parties in a manner conducive to sustainable growth and increased corporate value for Toray Group over the mid- to long-term while keeping the scope of fair and equitable information disclosure.

Specifically, Toray Group will establish the following systems.

- Appoint an officer responsible for IR

- Promote IR activities in an appropriate and effective manner at a full-time department for IR (Investor Relations Department)

- System to share internal information centered on the Investor Relations Department

- System to share feedback on information and opinions acquired through dialogue with the Board of Directors

- System to control internal information

- (6) Roles of corporate pension funds as asset owner

The Company determines the asset composition in percentage terms from a mid- to long-term perspective while considering risks and returns, in order to pay pensions to beneficiaries in a stable and certain manner through the Toray Corporate Pension Fund. Matters related to asset management are approved and decided at the Board of Representatives based on deliberations at the Asset Management Committee. Furthermore, the Company allocates human resources with appropriate talents to the Asset Management Committee and the Board of Representatives, mainly from the Personnel & Industrial Relations Division and Finance & Controller’s Division, to monitor the status of asset management.

Ⅱ. Basic Policy on Internal Control System

To realize the Management Philosophy, the Company shall establish a structure to execute its business legally and effectively by improving its internal control system according to the following basic policy as a structure to enable it to appropriately establish organization, formulate regulations, communicate information, and monitor the execution of operations.

1. System to ensure that the execution of duties by members of the Board and employees complies with laws and regulations and the Company’s Articles of Incorporation

- (1) Toray shall establish the Ethics and Compliance Committee, as one of the Group-wide committees to promote observance of corporate ethics and legal compliance, and shall take other measures to improve the required internal systems, including the establishment of dedicated organizations.

- (2) Toray shall establish the Ethics & Compliance Code of Conduct as specific provisions to be observed by members of the Board and employees, and shall take other measures to improve the required guidelines, etc. Especially with regard to eliminating relations with antisocial forces, the Company shall act as one to stand firmly against them.

- (3) Toray shall establish an internal reporting system (whistle-blowing system) for the reporting of the discovery of violation of laws, regulations, or the Company’s Articles of Incorporation.

- (4) Toray shall establish Security Trade Control Program, one of the most important legal compliance issues, and establish an organization dedicated to security export control.

2. System to ensure the efficient execution of duties by members of the Board and employees

- (1) Toray shall establish the Authority of Top Management to stipulate matters with respect to which decision-making authority is reserved by the Board of Directors and matters with respect to which decision-making is delegated to the President, General Managers, etc., from among matters necessary for decision-making.

- (2) Toray shall establish the Executive Committee as deliberative organs for important matters decided by the Board of Directors or the President. The Executive Committee shall deliberate on the general direction of policy or issues related to implementation.

3. System for preserving and managing information pertaining to the execution of duties by the members of the Board and employees

- (1) Toray shall establish regulations for important documents and important information related to management, confidential information and personal information, and appropriately preserve and manage them in accordance with the rules.

4. Regulations and other systems pertaining to controls over risks of loss

- (1) In order to identify potential risks in business activities, strive to mitigate such risks under normal business conditions, and prevent future crises, Toray shall establish the Risk Management Committee as one of the Group-wide committees to promote company-wide risk management, and improve regulations to enable immediate implementation in the event of a major crisis.

- (2) Toray shall establish an internal control system for financial reporting that ensures the reliability of financial reporting.

5. System for ensuring appropriate business operations within subsidiaries

- (1) To establish a system under which subsidiaries report to the Company on matters regarding the execution of duties by members of the Board, etc. of the subsidiaries, the Company shall provide regulations on the regular reporting of important management information to the Company and regularly hold conferences at which the Company’s management receives direct reports on the status of the management of the subsidiaries.

- (2) To establish regulations and other systems pertaining to controls over risks of loss for subsidiaries, the Company shall provide subsidiaries with guidance to help them to establish risk management systems appropriate for their respective business forms and business environments, and shall receive regular reports on the status of their activities.

- (3) To establish a system for ensuring that members of the Board, etc. of subsidiaries effectively execute their duties, the Company shall provide regulations on the scope under which the Company can reserve its authority over the execution of business operations. In addition, the Company shall endeavor to grasp management information in a unified manner and provide assistance and guidance necessary for subsidiaries by determining divisions, etc. with control over its respective subsidiaries.

- (4) To establish a system for ensuring that the execution of duties by members of the Board, etc. and employees of subsidiaries complies with laws and regulations and the Articles of Incorporation, the Company shall thoroughly familiarize its subsidiaries with the Company’s Ethics & Compliance Code of Conduct as a code of conduct in common for the Toray Group. At the same time, the Company shall request the subsidiaries to establish their own codes of conduct, guidelines, etc. in consideration of the laws and regulations, business practices, business forms, and other factors in their respective countries. In addition, the Company shall direct its subsidiaries to establish systems under which the status of internal whistle-blowing by members of the Board, etc. and employees of the subsidiaries is appropriately reported to the Company.

6. System for reporting to corporate auditors and systems for ensuring that persons who report to corporate auditors are not treated disadvantageously because of their reporting

- (1) Members of the Board, etc. and employees of Toray Group and corporate auditors of subsidiaries shall report matters regarding the execution of duties to corporate auditors in response to requests from the corporate auditors.

- (2) Department in charge of the internal reporting system (whistle-blowing system) shall regularly report the status of internal whistle-blowing in the Toray Group to the corporate auditors.

- (3) Toray shall stipulate regulations to the effect that members of the Board and employees who report to corporate auditors shall not be subjected to any disadvantageous treatment because of the said reporting, and shall provide subsidiaries with guidance to help them stipulate the same regulations.

7. Items pertaining to the handling of expenses and liabilities arising from the execution of duties by corporate auditors

- (1) Toray shall pay expenses, etc. incurred from the execution of duties by corporate auditors.

8. Items pertaining to employees assisting with corporate auditors’ duties, items pertaining to the independence of said employees from members of the Board, and items pertaining to the assurance of effectiveness of instructions from the corporate auditors to said employees

- (1) Toray shall assign a full-time employee to provide assistance if and when corporate auditors request assistance. The said employee shall exclusively follow the corporate auditors’ commands and instructions, and the Company shall consult with corporate auditors in advance with respect to the personnel arrangements for the said employee.

9. Other systems for ensuring effective implementation of audits by corporate auditors

- (1) Corporate auditors shall attend Board of Directors meetings and other important meetings so that they may ascertain important decision-making processes and the execution of operations.

- (2) Corporate auditors shall hold regular meetings with members of the Board and management and conduct regular visiting audits of Toray offices, plants, and subsidiaries.

Ⅲ. Standards for Judging the Independence of Outside Directors/Corporate Auditors

Toray Industries, Inc. (the “Company”) established the following standards for the independence of outside directors and outside corporate auditors (collectively, “Outside Director/Corporate Auditor”) to ensure the objectivity and transparency of governance.

If an Outside Director/Corporate Auditor or a candidate for Outside Director/Corporate Auditor is found not to fall under any of the following items as a result of an investigation of the candidate performed by the Company to a reasonably practicable extent, the Company shall judge that he/she possesses independence.

- An executive (Note 1) of the Company, its subsidiaries, or affiliated companies (collectively, the “Group”) or a person who has been an executive of the Group in the past 10 years.

- A current major shareholder of the Company (Note 2) or an executive thereof.

- A party of which the Group directly or indirectly holds 10% or more voting rights out of the total number of voting rights, or an executive thereof.

- A major client or supplier (Note 3) of the Group or an executive thereof.

- A person rendering professional services, such as a consultant, attorney-at-law, or certified public accountant, who receives a large amount of monetary consideration or other property (Note 4) from the Group besides remuneration as a member of the Board or corporate auditor (if the person receiving such property is a body such as a legal person and partnership, including a consulting firm, legal firm, or accounting firm, a person who belongs to such body).

- A person who receives a large donation (Note 5) from the Group (if the person receiving such large donation is a body such as a legal person and partnership, an executive thereof).

- An executive of a company in which an executive of the Group is elected as a member of the Board or corporate auditor.

- A person who has fallen under any of items 2 through 7 above in the past three years.

- If a person who falls under any of items 1 through 7 above is an important person (Note 6), a spouse or relative within the second degree of kinship thereof.

- Any other person who is likely to have conflicts of interest with general shareholders and is subject to circumstances reasonably deemed unable to fulfill his/her duties as an independent Outside Director/Corporate Auditor.

Notes

- An “executive” means an executive director, executive officer, operating officer of a legal person or other body, or other person or employee similar thereto. When judging the independence of an outside corporate auditor, a non-executive director is included.

- A “major shareholder” means a shareholder who holds shares with 10% or more of voting rights in his/her own name or another person’s name at the end of the most recent fiscal year of the Company.

- A “major client or supplier” means a person who comes under any of the following.

- (1) A business partner that has been provided with products, etc. by the Group and has made payments to the Company in an aggregate amount of not less than the higher of 2% of the annual consolidated net sales of the Company or one hundred million yen (¥100,000,000) in the most recent fiscal year.

- (2) A business partner that has provided the Group with products, etc. and has received payments from the Company in an aggregate amount of not less than the higher of 2% of the annual consolidated net sales of the business partner or one hundred million yen (¥100,000,000) in the most recent fiscal year.

- (3) A financial instutition that has extended a loan to the Group, whereby the outstanding balance of the loan is more than 2% of the consolidated total assets of the Company at the end of the fiscal year of the Company.

- A “large amount of monetary consideration or other property” means either of the following cases: (1) In the case where the person who provides professional services is an individual, the amount refers to the total amount of the relevant property received from the Group excluding remuneration as a director/corporate auditor, exceeding ten million yen (¥10,000,000) in the most recent fiscal year; and (2) In the case where the person who provides professional services is an entity such as a corporation or partnership, the amount refers to the total amount of the relevant property received from the Company, exceeding the higher of 2% of the consolidated net sales or total annual revenue of the relevant entity, or ten million yen (¥10,000,000) in the most recent fiscal year.

- A“large donation” means a donation from the Group to a recipient of more than ten million yen (¥10,000,000) annually in the most recent fiscal year.

- An “important person” means an executive director, executive officer, operating officer, or an employee who executes important operations, such as a person in charge of a division.