Corporate Governance

Basic policy

From the outset, one of Toray Group's managerial principles has been that the purpose of a company is to contribute to society. The Group has developed the Toray Philosophy that incorporates this principle.

The Group systematizes the Toray Philosophy as a Corporate Philosophy, Corporate Missions, Corporate Guiding Principles, etc. Among these, the Corporate Missions call for desirable relationships with stakeholders and enunciate the Group’s commitment "To provide our shareholders with dependable and trustworthy management." In addition, the Corporate Guiding Principles stipulate the Group’s commitment to "Acting with fairness, high ethical standards and a strong sense of responsibility while complying with laws, regulations and social norms to earn trust and meet social expectations."

When establishing the corporate governance structure, the Group seeks to realize these philosophies as its basic policy.

- Basic Policy on Internal Control

- Standards for Judging the Independence of Outside Directors/Corporate Auditors

Corporate Governance Report

Toray files a Corporate Governance Report with the Tokyo Stock Exchange.

Corporate Governance Structures

Current System

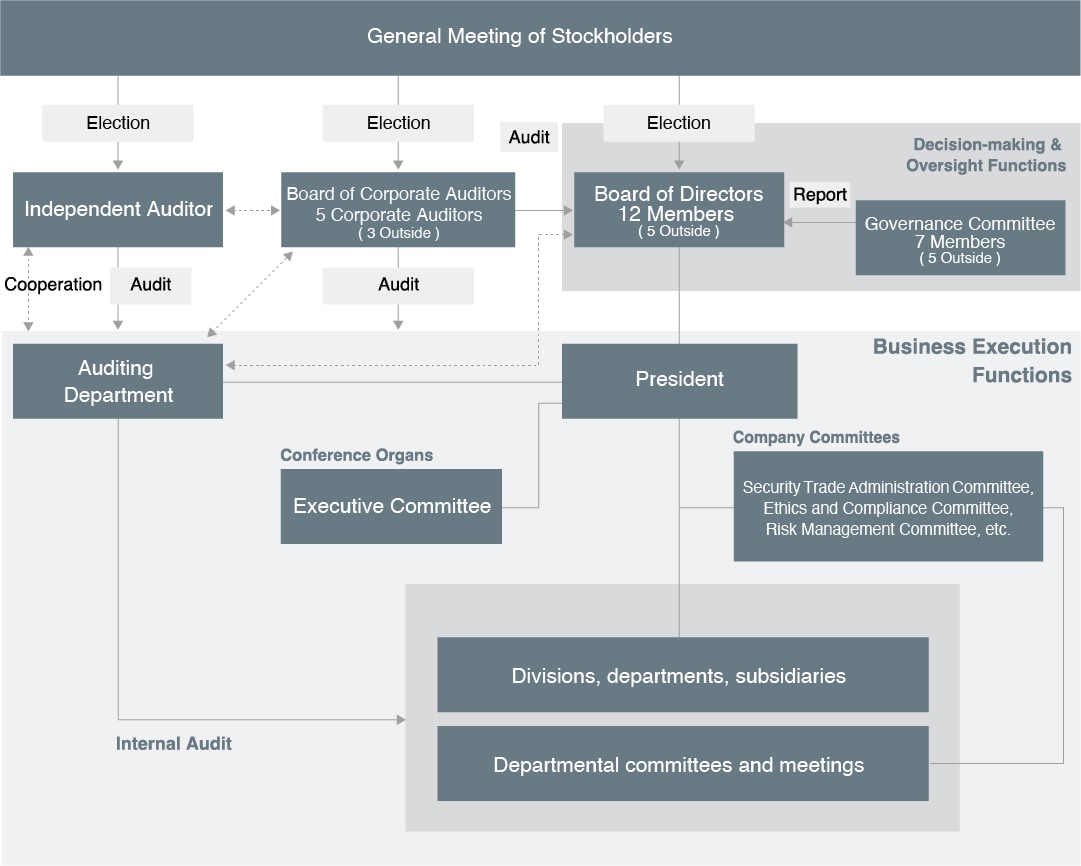

Toray is a company with Board of Corporate Auditors, and the members of the Board and corporate auditors are elected at the general meeting of shareholders. A summary of the system is illustrated in the figure <Corporate Governance Structures>.

Members of the Board and corporate auditors, as officers directly elected at the general meeting of shareholders, clearly recognize fiduciary responsibility to shareholders who have entrusted the management and appropriately fulfill their respective roles while discharging accountability about management status to shareholders and other stakeholders.

As Toray Group supplies a wide range of industries with basic materials and globally plays an active part in a broad scope of business fields, it is necessary to evaluate various risks multilaterally based on expertise relevant to the worksites, not only for management judgment and decision-making but also for oversight. To that end, the Board of Directors formulates a structure in which members of the Board familiar with the Toray Group businesses oversee management and make decisions from various viewpoints. Furthermore, the Board of Corporate Auditors audits the execution of operations by the members of the Board based on professional knowledge in fields such as finance, accounting and law in addition to an understanding about businesses, from a standpoint entirely independent of the Board of Directors as a system to secure transparency and fairness of oversight and decision-making.

Corporate Governance Structures

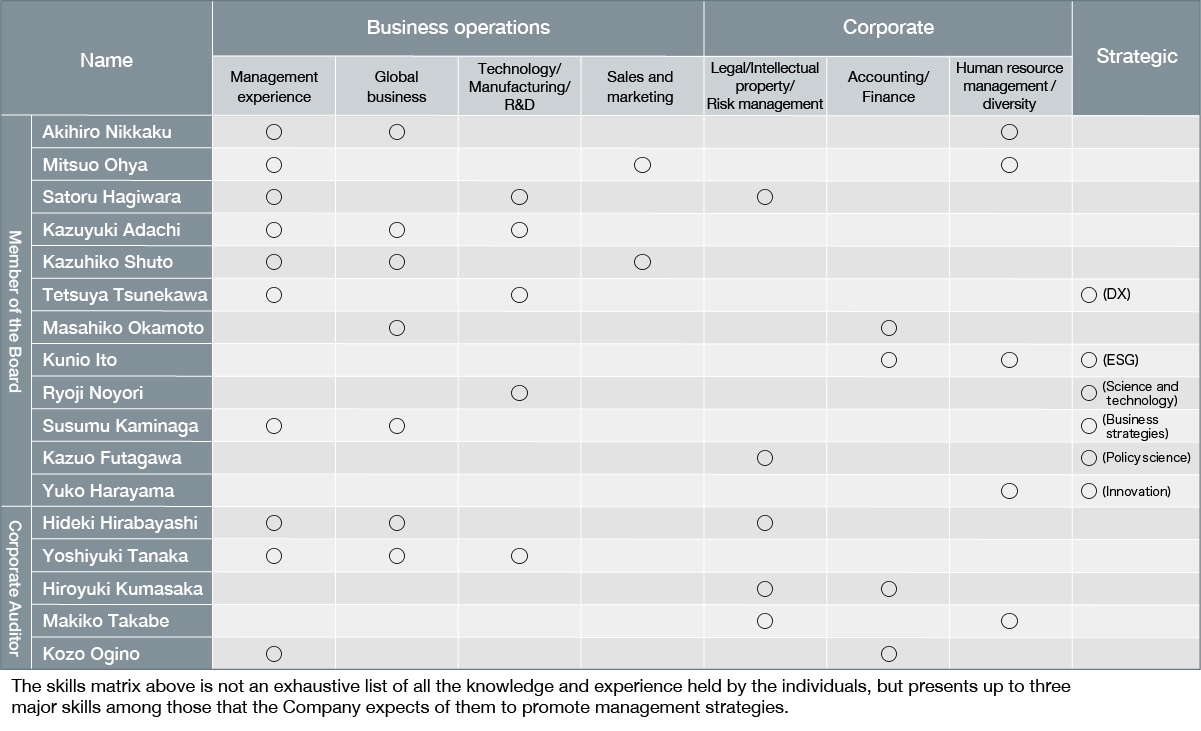

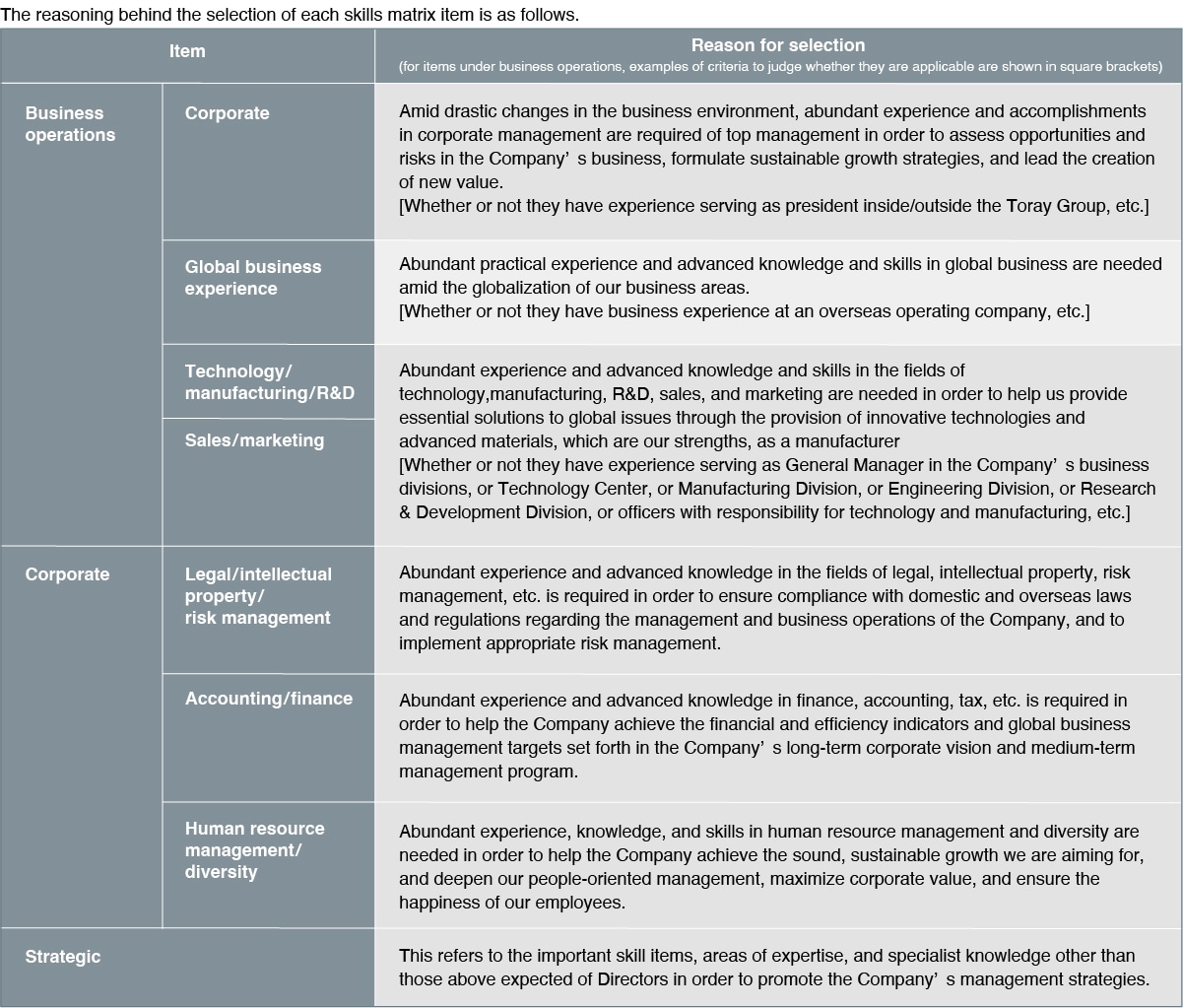

Skill Matrix

Remuneration of Directors

- Policy for determining the details of individual remuneration to members of the Board

Decision-making policy for determining the details of individual remuneration to members of the Board of the Company (the “Decision-making Policy”) is as follows.- ⅰ) Basic policy

To lead to improvements in the Toray Group’s mid- to long-term corporate value and sustainable growth, Toray has established a remuneration system for members of the Board. With respect to the Decision-making Policy for the remuneration system for members of the Board, in addition to matters stipulated by laws and regulations, the decision-making rights on important matters are reserved by the Board of Directors based on the Authority of Top Management. Particulars of the agenda regarding remuneration for members of the Board at the general meeting of stockholders, and the formulation and revision of important internal regulations, as well as individual remuneration to members of the Board, are determined by resolution of the Board of Directors. The remuneration system for members of the Board is continually reviewed by the Governance Committee. - ⅱ) Composition and level of remuneration

Given their roles, remuneration for internal members of the Board consists of basic remuneration which is a fixed amount, as well as a performance-based remuneration, including bonus which takes into account the consolidated business results for each fiscal year, etc., and stock acquisition rights as stock options, which are linked to medium- to long-term business results. Given their roles, remuneration for outside directors consists of basic remuneration only. Remuneration is set at a level that enables the Company to secure superior human resources and further motivate them to improve performance, referring to the results of a survey of other companies’ remuneration by an external third-party organization. The Company undertakes reviews of the payment ratios of performance-based remuneration and remuneration, etc. other than performance-based remuneration as appropriate, based on the results of a survey of other companies’ remuneration and reviews at the Governance Committee, etc. - ⅲ) Basic remuneration

With respect to basic remuneration the maximum limit of total remuneration is determined at general meetings of stockholders. Particulars of the agenda at the general meeting of stockholders are determined by the Board of Directors following a report from the Governance Committee. Within the scope of the maximum limit, basic remuneration to each member of the Board is determined by the Board of Directors after the Governance Committee makes a report to the Board of Directors. Basic remuneration consists of monthly remuneration of a fixed amount. - ⅳ) Bonuses

The provision and the total amount of bonuses are determined each time at a general meeting of stockholders. Particulars of the agenda at the general meeting of stockholders are determined by the Board of Directors following a report from the Governance Committee with consideration given to the consolidated core operating income for each fiscal year that best represents the results of the Company’s global business operations, plus the historical record, etc. The individual bonus for each internal member of the Board is determined by the Board of Directors after the Governance Committee makes a report to the Board of Directors. Bonuses are to be paid at a certain time every year. - ⅴ) Stock Acquisition Rights as stock options

The maximum limit of total number of Stock Acquisition Rights as well as the limit of remuneration relating to the granting of the Stock Acquisition Rights as stock options to internal members of the Board is resolved at the general meeting of stockholders. Particulars of the agenda at the general meeting of stockholders are determined by the Board of Directors following a report from the Governance Committee. Within that limit, the total number of Stock Acquisition Rights to be allocated to each internal member of the Board shall be determined at the Board of Directors meeting based on the standards determined by the Board of Directors after the Governance Committee makes a report to the Board of Directors. A basic remuneration amount paid to each internal member of the Board and an amount of remuneration equal to the paid-in amount of Stock Acquisition Rights to be allocated to each internal member of the Board shall be determined by the Board of Directors meeting after the Governance Committee makes a report to the Board of Directors. Stock Acquisition Rights as stock options are granted at a certain time every year. - ⅵ) Others

At the 130th Ordinary General Meeting of Stockholders, the payment of retirement allowances to members of the Board for termination resulting from the abolition of the retirement allowance program for members of the Board was resolved. It was also resolved that retirement allowances were to be paid to internal members of the Board in office at the close of the said general meeting for the services they rendered up to the close of the said general meeting. The retirement allowance to be paid to each internal member of the Board is determined based on a resolution at a Board of Directors meeting after the 130th Ordinary General Meeting of Stockholders. The retirement allowance is paid at the time of retirement of each internal member of the Board.

The Decision-making Policy was determined with a resolution of the Board of Directors meeting held on February 9, 2021 through deliberations at the Governance Committee and amended by a resolution of the Board of Directors meeting held on March 28, 2022.

Regarding details of remuneration to individual members of the Board, the remuneration system is continuously reviewed by the Governance Committee. Based on the results, the Governance Committee makes a report to the Board of Directors, which makes a resolution. Accordingly, the Board of Directors believes that the said details are in line with the Decision-making Policy.

Given their roles, remuneration for corporate auditors consists of basic remuneration only, which is a fixed amount. Remuneration is set at a level that enables the Company to secure superior human resources, referring to the results of a survey of other companies’ remuneration by an external third-party organization. With respect to basic remuneration, the maximum limit of total remuneration is determined at general meetings of stockholders. Basic remuneration to each corporate auditor is determined, within the scope of the maximum limit, through discussion by corporate auditors.

- ⅰ) Basic policy

- Resolution at the general meeting of stockholders on remuneration to members of the Board and corporate auditors

- ⅰ) Basic remuneration to members of the Board

- Date of resolution: June 23, 2022 (141st Ordinary General Meeting of Stockholders)

- Details of resolution: The amount of remuneration to members of the Board was ¥50 million or less per month (including within ¥7 million for outside directors).

The portion of employee’s salary of the employee-director was excluded. - Number of covered members of the Board: 12 (including four outside directors)

- ⅱ) Basic remuneration to corporate auditors

- Date of resolution: June 25, 2019 (138th Ordinary General Meeting of Stockholders)

- Details of resolution: The amount of remuneration to corporate auditors was ¥11 million or less per month.

- Number of covered corporate auditors: 5

- ⅲ) Stock Acquisition Rights as stock options to members of the Board

- Date of resolution: June 24, 2011 (130th Ordinary General Meeting of Stockholders)

- Details of resolution: The limit of remuneration relating to the granting of the Stock Acquisition Rights as stock options to members of the Board was determined to be ¥300 million per year and the maximum limit of the total number of Stock Acquisition Rights was determined to be 1,200 per year.

- Number of covered members of the Board: 28

- ⅳ) Payment of retirement allowances to members of the Board and corporate auditors for termination

- Date of resolution: June 24, 2011 (130th Ordinary General Meeting of Stockholders)

- Details of resolution: The retirement allowances for termination are to be paid to the members of the Board and corporate auditors for the services they rendered up to the close of the said general meeting, resulting from the abolition of the retirement allowance program for members of the Board and corporate auditors. The retirement allowance is paid at the time of retirement of each member of the Board and corporate auditor.

- Number of covered members of the Board: 23

Number of covered corporate auditors: 2

- ⅰ) Basic remuneration to members of the Board

- Total amount of remuneration to members of the Board and corporate auditors

(Millions of yen)

Category Total amount of remuneration Total amount of remuneration by type Number of covered members of the Board and corporate auditors Basic remuneration Performance-based remuneration Bonus Non-monetary remuneration Stock Acquisition Rights as stock options Members of the Board

[including outside directors]732

[71]552

[71]69

[−]111

[−]15

[5]Corporate auditors

[including outside corporate auditors]115

[36]115

[36]−

[−]−

[−]8

[5]Note 1: The number of members of the Board and corporate auditors includes two members of the Board and three corporate auditors who retired in the current period. Note 2: The amount equivalent to \4 million of employee’s salary of the employee-director is not included in the above amount. Note 3: The amount of bonuses to members of the Board is scheduled to be resolved at the 143rd Ordinary General Meeting of Stockholders. The amount of bonuses is calculated with consideration given to the consolidated core operating income for the current period, plus the historical record, etc. Changes in the consolidated core operating income, including that for the current period, are stated in 1. Review of Operations of Toray Group, (3) Financial Highlights. Note 4: With regard to the Stock Acquisition Rights granted as stock options to members of the Board, changes in the issue prices of Stock Acquisition Rights as stock options, including those for the current period, are stated in 3. Stock Acquisition Rights, (1) Outline of Stock Acquisition Rights Granted to Members of the Board of the Company as a Consideration for the Performance of Duties and Held as of the end of the Fiscal Year.

Major Activities of Outside Members of the board at Meetings of the Board of Directors and Board of Auditors

| 区分 | 氏名 | 主な活動状況 |

|---|---|---|

| Outside Director | Kunio Ito | Attended all 14 meetings of the Board of Directors held during the period under review. Contributed to these meetings with appropriate comments from his professional perspective based mainly on experience of research and study activities on accounting and business administration. In addition, served as a chairman of the Governance Committee, a voluntary committee, and worked to improve governance by offering comments on matters concerning nomination and remuneration such as basic policy for the selection and dismissal of executive managers and on enhancement of the effectiveness of the Board of Directors. |

| Ryoji Noyori | Attended all 14 meetings of the Board of Directors held during the period under review. Contributed to these meetings with appropriate comments from his academic and technological perspective based mainly on experience of research and study activities on organic synthetic chemistry. In addition, served as a member of the Governance Committee, a voluntary committee, and worked to improve governance by offering comments on matters concerning nomination and remuneration such as basic policy for the selection and dismissal of executive managers and on enhancement of the effectiveness of the Board of Directors. | |

| Susumu Kaminaga | Attended 13 out of 14 meetings of the Board of Directors held during the period under review. Contributed to these meetings with appropriate comments based on his rich experience as a corporate executive, as well as international perspective and experience as an outside director of another company. In addition, served as a member of the Governance Committee, a voluntary committee, and worked to improve governance by offering comments on matters concerning nomination and remuneration such as basic policy for the selection and dismissal of executive managers and on enhancement of the effectiveness of the Board of Directors. | |

| Kazuo Futagawa | Attended all 14 meetings of the Board of Directors held during the period under review. Contributed to these meetings with appropriate comments based on his rich experience and knowledge and advanced expertise as an administrative officer. In addition, served as a member of the Governance Committee, a voluntary committee, and worked to improve governance by offering comments on matters concerning nomination and remuneration such as basic policy for the selection and dismissal of executive managers and on enhancement of the effectiveness of the Board of Directors. | |

| Yuko Harayama | Attended all 10 meetings (Note) of the Board of Directors held during the period under review. Contributed to these meetings with appropriate comments based on her rich experience and advanced expertise as a university professor, as well as her knowledge gained by engaging in science, technology and innovation policies. In addition, served as a member of the Governance Committee, a voluntary committee, and worked to improve governance by offering comments on matters concerning nomination and remuneration such as basic policy for the selection and dismissal of executive managers and on enhancement of the effectiveness of the Board of Directors. | |

| Outside Corporate Auditor | Hiroyuki Kumasaka | Attended all 14 meetings of the Board of Directors and all 11 meetings of the Board of Corporate Auditors held during the period under review. Also participated in audits of Toray’s plants and Group companies. Contributed to these meetings and audits with appropriate comments based mainly on his professional perspective as a certified public accountant. |

| Makiko Takabe | Attended all 10 meetings (Note) of the Board of Directors and all 7 meetings (Note) of the Board of Corporate Auditors held during the period under review. Also participated in audits of Toray’s plants and Group companies. Contributed to these meetings and audits with appropriate comments based mainly on her professional perspective as a lawyer. | |

| Kozo Ogino | Attended all 10 meetings (Note) of the Board of Directors and 6 out of 7 meetings (Note) of the Board of Corporate Auditors held during the period under review. Also participated in audits of Toray’s plants and Group companies. Contributed to these meetings and audits with appropriate comments based on his professional perspective as an experienced executive. |

Note: The number of meetings held after their assumption of office in June 2023 is stated.