- HOME

- Investor Relations

- Management Policy

- Shareholders Return

Shareholders Return

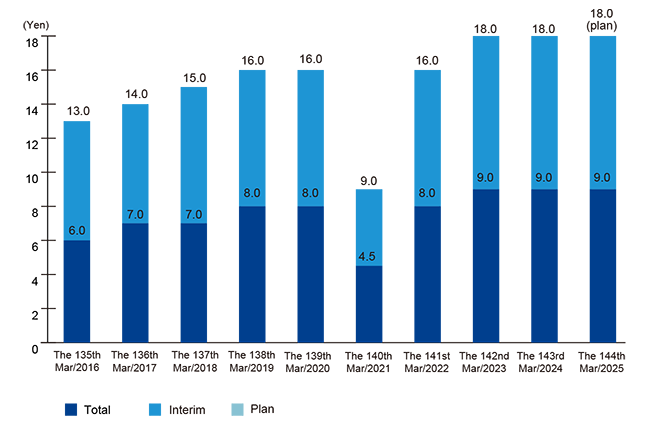

- Policies on shareholders return mentioned in the Medium-Term Management Program AP-G 2025 are as follows:

- While maintaining stable continuous dividends, aiming to increase dividends based on earning growth,

- Target for dividend payout ratio is 30% or more.

Dividends

J-GAAP

Yen, %

| (FY) | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Interim | 6.0 | 7.0 | 7.0 | 8.0 | 8.0 |

| Year-end | 7.0 | 7.0 | 8.0 | 8.0 | 8.0 |

| Total | 13.0 | 14.0 | 15.0 | 16.0 | 16.0 |

| Net Income per Share | 56.38 | 62.17 | 59.97 | 49.61 | 34.83 |

| Payout Ratio | 23.1% | 22.5% | 25.0% | 32.3% | 45.9% |

IFRS

Yen, %

| (FY) | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| Interim | 4.5 | 8.0 | 9.0 | 9.0 | 9.0 | 10.0 (plan) |

| Year-end | 4.5 | 8.0 | 9.0 | 9.0 | 9.0 | 10.0 (plan) |

| Total | 9.0 | 16.0 | 18.0 | 18.0 | 18.0 | 20.0 (plan) |

| Earnings per Share | 28.61 | 52.63 | 45.49 | 13.67 | 48.93 | 52.44 (estimate) |

| Payout Ratio | 31.5% | 30.4% | 39.6% | 132% | 37% | 38% (estimate) |

- * Toray Group has applied the International Financial Reporting Standards (IFRS) from the first quarter of the fiscal year ended March 31, 2021.

The financial figures for the fiscal year ended March 31, 2020 are presented in accordance with IFRS in addition to Japanese generally accepted accounting principles.