- HOME

- Investor Relations

- Management Policy

- Business Risks

Business Risks

Uncertainties in business operations are increasing due to increase in the occurrence of large-scale natural disasters, rising geopolitical risks such as military invasions and economic security. Toray Group established a system to respond quickly to rapidly emerging risks and crises, and a dedicated organization oversees risk management during normal times and immediate response in the event of a crisis. However, if any risks were to occur, they could affect the Group’s results of operations and financial conditions.

(1) Risk management structure and activities in Toray Group

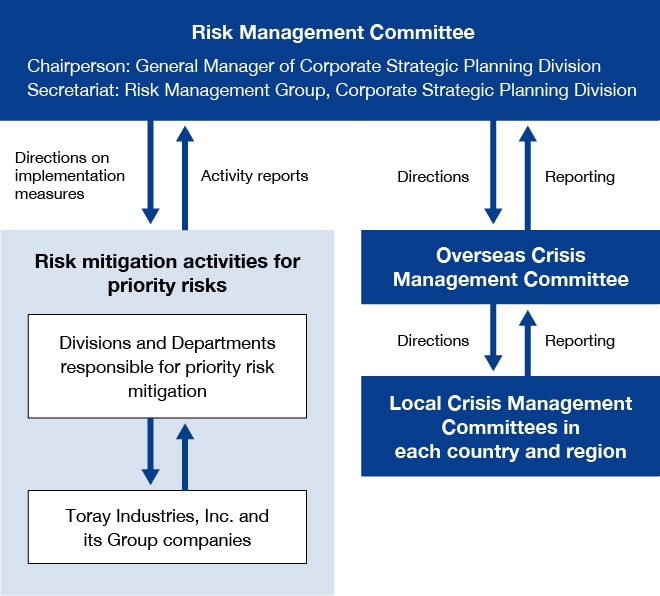

In order to respond to risks that rapidly emerge due to changes in the surrounding environment and to respond immediately in the event of a crisis, Toray Group has a dedicated organization within the Corporate Strategic Planning Division to communicate closely with the Board of Directors and top management and to pursue risk management as an integral part of the management strategy. The Group has the Risk Management Committee, chaired by the General Manager of the Corporate Strategic Planning Division, to deliberate, discuss, and share information to promote risk management (see Figure 1). The Risk Management Committee regularly reports the result of deliberations and discussions to the Board of Directors and reports important emergency matters whenever such occur to the Board of Directors without fail. In addition, as subordinate organizations of the Risk Management Committee, the Overseas Crisis Management Committee and Local Crisis Management Committee have been established to manage employees’ overseas travel under normal conditions and compile information on overseas risks.

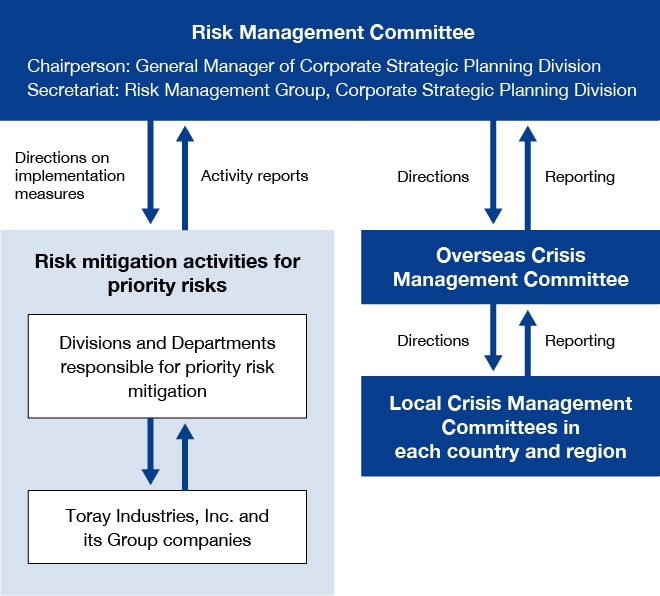

The Group defines risk management as overseeing risk management during normal times and immediate response in the event of a crisis. For risk management in normal times, the Group has implemented a PDCA cycle to manage Toray Group Priority Risks (hereinafter referred to as Priority Risks) and Specified Risks (see Figure 2).

According to periodic (once every three years) assessment of risks that have been exhaustively identified, Priority Risks are set based on those with a high degree of potential risk (probability of occurrence × degree of impact), and the division or department responsible for mitigating each risk focuses on risk mitigation.

Specified Risks are determined by a dedicated department in the Corporate Strategic Planning Division that routinely monitors domestic and overseas trends, conducts surveys and analyses, identifies and assesses risks that may have a major impact on management, and consults with top management.

Specified risks include risks arising in a short period of time, and have a complementary relationship with priority risks, which are three years as one term.

In the event of a crisis, a quick response system is established according to the level of the crisis, in accordance with internal regulations.

(2) Identifying and evaluating risks

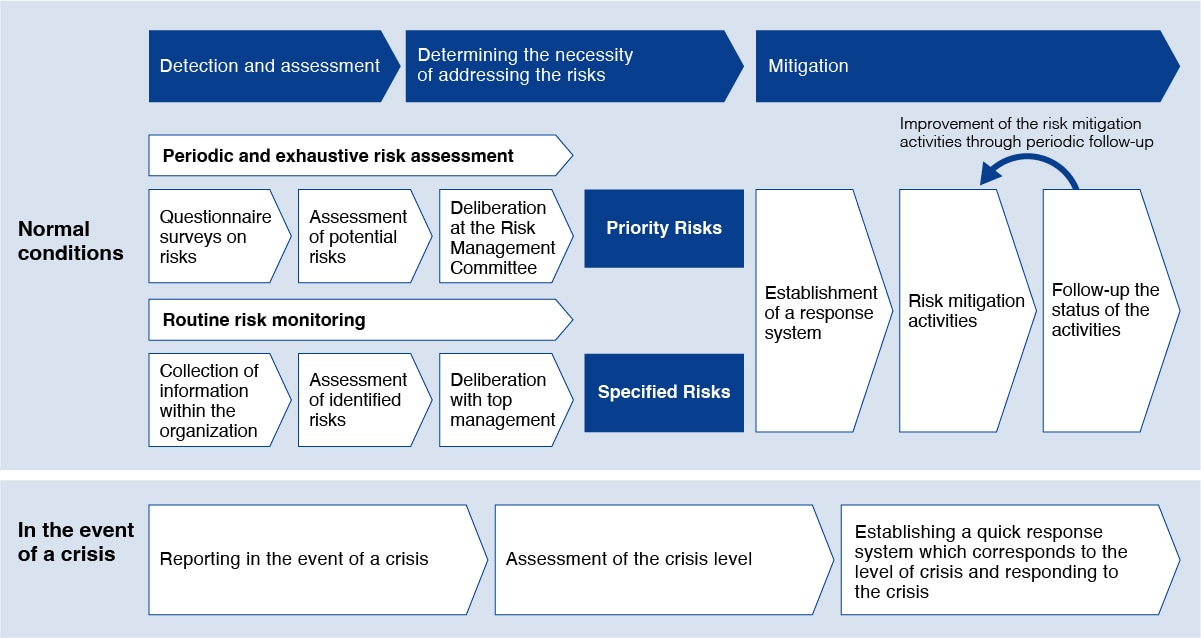

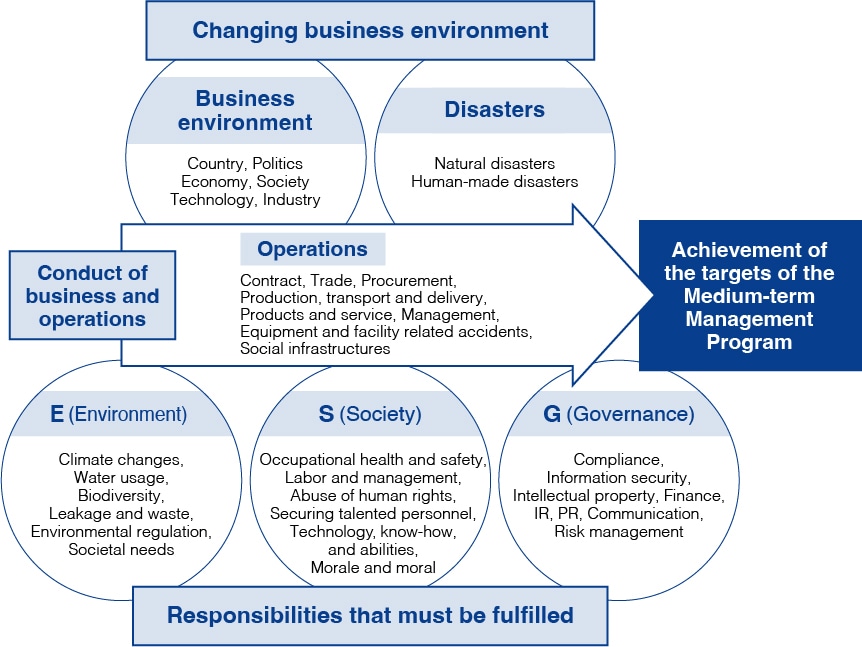

In 2022, Toray Group implemented the sixth three-year set of priority risks from FY 2023 to 2025 of identifying and evaluating Priority Risks. In this term, the main objective was to identify and evaluate risks for the entire Group that could hinder the achievement of the targets of the Medium-Term Management Program from FY 2023-2025. For identifying and evaluating, following process was used.

- (a) A survey was conducted to identify the imminence of risks as well as specific concerns in Toray Group’s functional departments and domestic and overseas affiliates, targeting 118 risks (see Figure 3) comprehensively organized in the categories of "business environment," "disasters," "operations," "E (environment)," "S (society)," and "G (governance)" surrounding the Group.

- (b) After aggregating and analyzing information obtained from the survey, discussions on risk awareness, issues, and countermeasures were held with risk-related departments and top management.

- (c) Summarizing the analysis of the questionnaire survey and information obtained from the discussions, draft of Priority Risk is deliberated and decided by the Risk Management Committee.

Figure 3. Identifying Risks that Inhibit the Achievement of the Targets of the Medium-Term Management Program

(3) Priority Risks

As Priority Risks for the sixth three-year set of priority risks from FY 2023 to 2025, Toray promotes following two themes.

| Summary of the risk |

In the event of deterioration in public security becomes the norm, or an occurrence of outbreak of war and conflict where the Group's overseas companies are located, the following risks may increase.

|

|---|---|

| Toray Group’s response | Toray Group, which operates businesses globally, has established the Overseas Crisis Management Committee which collaborates with the overseas affiliates (representative of each country or region and president of each company) and promotes establishment of preventive measures against crises that may occur overseas and response systems for emergency. However, with the outbreak of the conflict between Russia and Ukraine in February 2022, Toray Group has determined that it is necessary to review the systems and rules on the basis of war risks and strengthen countermeasures by positioning this theme as Priority Risk. Going forward, setting the Corporate Strategic Planning Division as the department in charge of promoting initiatives for this risk, Toray Group will provide scenarios to respond to a crisis conceivable to occur at the group company locations, in cooperation with the Local Crisis Management Committee in each country and region. For high-risk countries and regions, the Group will prepare, disseminate, and drill contingency plans. Through these initiatives, the Toray Group aims to reduce risks by ensuring the safety of its employees as well as speeding up decision-making and actions for business continuity at where the Group business sites are located. |

| Summary of the risk |

The following risks may increase due to tight procurement of raw materials and parts required for production, or invocation of force majeure clauses by suppliers, which occur in conjunction with changes in market conditions including crude oil price fluctuations, geopolitical issues such as political situations in resource-rich countries, environmental issues such as climate change, and social disruption such as human rights issues.

|

|---|---|

| Toray Group’s response | Based on the recognition that the Toray Group has social responsibilities and the mission to provide stable supply of materials required for manufacturing products that are essential for people’s daily lives or important to the Group’s business strategies, it has been proactively strengthening supply chains through initiatives including formulation of a business continuity plan (BCP). Meanwhile, as stipulated in the “summary of the risk”, given significant changes in conditions and assumptions for stable supply due to rapid changes in the environment surrounding global supply chains, the Group has positioned this theme as Priority Risk and decided to enforce the countermeasures. Going forward, promotion system centered on the purchasing & logistics division will be responsible for organizing information on vulnerabilities in supply chains and clarifying and implementing risk mitigation measures such as multiple purchasing of raw materials and recipe changes, in order to strengthen the continuity of product supply. |

(4) Major risks

(Classification: listed in the order of Business, E (environment), S (society), G (governance))

In addition to Priority Risks, major risks that Toray Group has evaluated which may have significant impacts are listed below. They include risks evaluated as having a large impact based on the aforementioned risk assessment as well as risks that each business unit has identified as requiring response. Risk mitigation measures are promoted mainly by group-wide committees, dedicated departments, and business divisions.

| Risks related to product demand, market trends, and business plans | Classification | Business | |

|---|---|---|---|

| Summary of the risk |

As a supplier of basic materials to a broad range of industries, Toray Group is exposed to various factors including a sharp drop in demand for its products caused by changes in both worldwide and regional supply-demand conditions, increased use of substitute materials, and changes to the purchasing policies of business partners. Due to these factors, the following risks could increase.

|

||

| Toray Group’s response |

In order to respond to changes in product demand and market conditions, Toray Group continues to make a great effort to secure competitive advantage of its products and makes capital expenditures in a wide range of business fields. Furthermore, for business expansion and enhancement of competitiveness, its other activities include formation of various joint ventures or strategic alliances with third parties as well as business acquisitions after thorough consideration of profitability and the possibility of investment return from a variety of perspectives. To achieve the targets of the Medium-Term Management Program, Project AP-G 2025, various challenges such as business portfolio improvement (business expansion, new entry and diversification of application), new sales channel development, efficient differentiated product development without rework, review of supply chains, and inventory optimization, are set and promoted in each business field. |

||

| Risks related to global business development | Classification | Business | |

| Summary of the risk |

Toray Group is developing a broad geographical presence, with operations in various countries including Asia, Europe, and the U.S. However, economic security risks are increasing with the prolonged conflict between the U.S. and China, and this may increase the following risks in each region.

|

||

| Toray Group’s response | In 2021, Toray Group established a dedicated team for economic security within the Corporate Strategic Planning Division to respond to risks. The team consists of a wide range of members from legal, purchasing & logistics, marketing, to technology fields. The team has functions such as collecting information from the U.S., China and other countries, making an analysis and disseminating the collected information within the Group, creating mechanisms to avoid and mitigate risks based on an understanding of the Group's business activities (supply chain, funds, R&D, human resource management, data management, etc.), and taking agile action when risks materialize. | ||

| Risks related to foreign currency, interest rate and securities market fluctuations | Classification | Business | |

| Summary of the risk |

Toray Group engages in foreign currency-denominated transactions, including procurement of raw materials and other items. Items in the financial statements of business operations outside Japan are translated into yen for preparing consolidated financial statements. The Group raises funds mainly by borrowing from financial institutions and issuing commercial paper and corporate bonds. These include following risks.

|

||

| Toray Group’s response | Leveraging strengths of the Group of having business sites around the world, Toray Group promotes local production for local consumption and makes an effort to build management structure invulnerable to foreign currency fluctuations by flexibly expanding its global operations. Moreover, representative of the head office and each country or region, chief financial and accounting officers of each region, and representatives of overseas affiliates stay up-to-date on the latest information and share them within the Group, while hedging risks with forward exchange contracts on foreign currency-denominated bonds and debts to respond to sudden fluctuations in exchange rates. To prepare for the sharp rise of the interest rate in the future, Toray Group will closely monitor interest rate trends and execute financing in an optimal manner. | ||

| Risks related to environmental issues such as climate change, water shortages, and resource depletion | Classification | E (Environment) | |

| Summary of the risk |

The following risks may increase due to the global climate change concerns and rising expectations for companies’ actions to counter climate change, the following risks may increase for Toray Group.

|

||

| Toray Group’s response | Toray Group has been committed to providing solutions to various global issues such as climate change, water shortages, and resource depletion, by establishing the Global Environment Committee in the 1990s. In order to work on initiatives for the realization of Toray Group Sustainability Vision, Toray Group has established the Sustainability Innovation (SI) Business Expansion Project and Climate Change Project to develop and promote medium- and long-term road maps and action plans for climate change and circular economy, and manages progress to achieve the targets for 2030. In addition, the Executive Committee, which assists the Board of Directors and is a consultative body for important company-wide matters, discusses the contents of the projects and important sustainability-related policies and agendas to promote measures to address climate change-related risks both in a group-wide and in a flexible manner. | ||

| Risks related to natural disasters and accidents | Classification | E (Environment) | |

| Summary of the risk |

Climate change is raising the risk of natural disasters such as typhoons, floods, and other storm and flood damages. Toray Group could have following risks.

|

||

| Toray Group’s response | Toray Group places top priority on safety, accident prevention, and environmental preservation. To minimize losses caused by the suspension of production, the Production Division Executive Meeting, an advisory board to study and deliberate on safety, disaster prevention, and environmental preservation, conducts regular accident prevention inspections, maintenance of its manufacturing facilities, and safety activities. For mega-earthquake and mega-flood, the Group has established guidelines to promote safety measures for employees and local communities as well as continuing business. | ||

| Risks related to human resource strategies | Classification | S (Society) | |

| Summary of the risk |

Due to diversification of work style and perspectives on employment, declining working population, and acceleration of longevity and aging , the environment surrounding human resource strategies is changing. Toray Group faces following risks.

|

||

| Toray Group’s response |

Since its foundation, the Group has taken various measures in response to changes in the socioeconomic situation and business management environment, based on the idea "a company is its people”. Against the backdrop of the recent environmental complexity related to human resource strategies, in the Medium-Term Management Program, Project AP-G 2025, “Enhancement of people-centric management” is set as one of the management strategies. Led by the Human Resources Division and the General Administration & Communications Division, Toray Group is striving to inherit and develop a corporate culture that nurtures people, and enrich individual career development as well as promoting job satisfaction, in collaboration with each business, country and region. The Group will strengthen its human resource base by securing and promoting diverse human resources, developing human resources by supporting self-reliant career development and skill learning, in addition to realizing job satisfaction and supportive workplaces by fostering an organizational culture that values feedback from the frontlines. |

||

| Risk related to compliance | Classification | G (Governance) | |

| Summary of the risk |

Various laws and regulations apply in the countries and regions where Toray Group conducts its business. These laws and regulations include those in relation to the environment, commercial trading, labor, intellectual property, taxation and foreign exchange, investment approval protocols and import/export controls, and policies on competition based on antitrust laws. Toray could have following risks.

|

||

| Toray Group’s response |

Led by the Ethics and Compliance Committee, a group-wide committee, Toray Group aims to deepen ethics and compliance activities of entire Toray Group and further enhance compliance awareness by deterring risk from the perspectives of motivation, opportunity, and justification, creating an organizational culture that prevents misconduct, and promoting the use of the whistleblower system and AI tools.

Through establishment and maintenance of internal control systems, Toray Group endeavors to comply with all such laws and regulations and aims to further improve internal control through enhancement of workplace competency of domestic and overseas affiliates. |

||

| Risks related to information security and cyber threats | Classification | G (Governance) | |

| Summary of the risk |

Regarding important technical information and trade secrets, incidents of theft by malicious persons inside and outside of a company continue to occur around the world, and issues on handling information have become increasingly complicated (e.g. GDPR, application of data protection laws due to the U.S.-China conflict, and economic security, etc.). Therefore, Toray Group could have following risks.

|

||

| Toray Group’s response |

Toray Group’s information systems and networks are fundamentally essential in the execution of the Group’s business operations and every security precaution is taken in their development and operation. In 2022, the Group established the Toray Group Information Security Steering Committee, which centrally manages information security of the group companies, and changed the system from individual optimization of each company to optimization of the entire Group. Under the supervision and management of the committee, Toray has established the Toray Group Information Security Basic Policy, and aims to maintain and improve information security by monitoring the risk status of the entire Toray Group and global trends, formulating Group-wide security management standards, following up on the implementation status, and conducting periodic security assessment and monitoring. |

||