- HOME

- Investor Relations

- To Our Investors

- Medium-Term Management Program

Medium-Term Management Program

Project AP-G 2025

Innovation and Resilience Management —

Value Creation for New Momentum

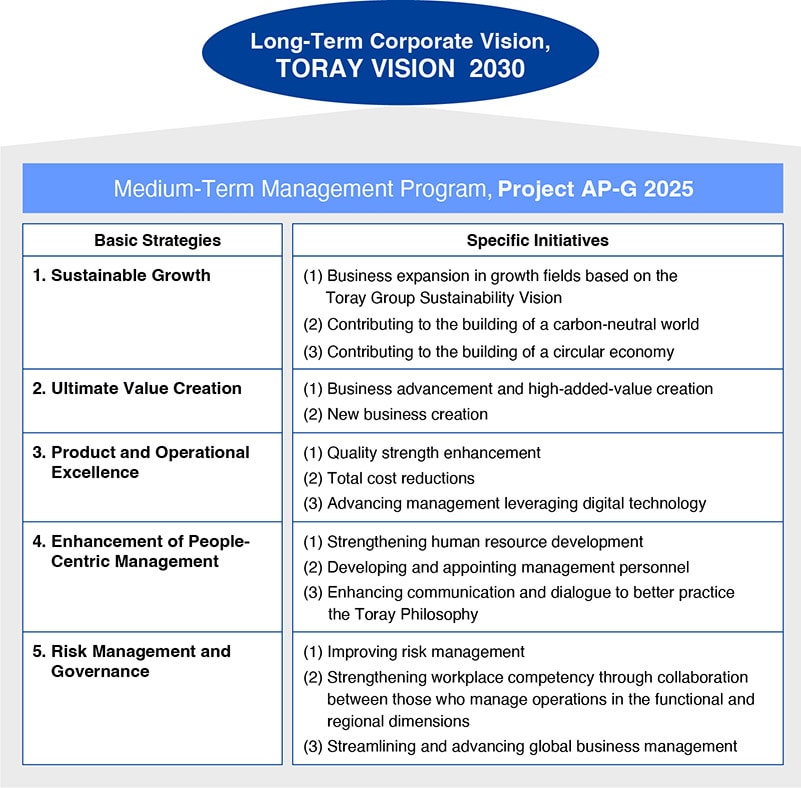

The new Medium-Term Management Program, Project AP-G 2025 (AP-G 2025) covers the three-year period from fiscal 2023 to fiscal 2025. It takes the Toray Philosophy as its starting point and is designed to ensure the Toray Group achieves sound, sustainable growth by helping to solve global issues arising from the need to balance development and sustainability, as indicated in the Toray Group Sustainability Vision. Under AP-G 2025, we will focus on creating value to fuel this growth strategy and enhance our human resource base to support it. We will strengthen our management foundation to enable investment in growth driven by efficiently invested capital, financial strength, and human resources.

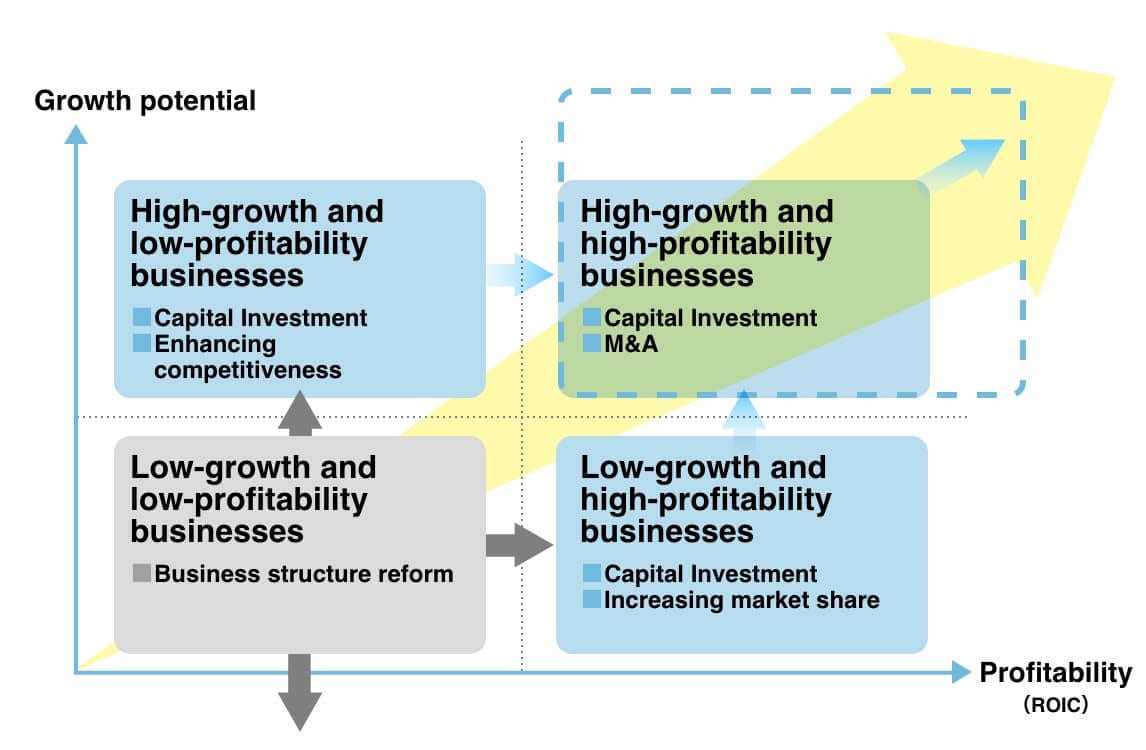

Under AP-G 2025, our five basic strategies are: sustainable growth; ultimate value creation; product and operational excellence; enhancement of people-centric management; and risk management and governance. We will work to expand our growth fields of Sustainability Innovation (SI) Business and Digital Innovation (DI) Business, while pursuing business advancement and high-added-value creation as well as enhancing quality strength and cost competitiveness. At the same time, in order to maintain financial soundness, we will focus across our business operations on balancing profit, cash flow, and asset efficiency. Furthermore, in order to create a new growth trajectory, we will expand high-growth, high-profitability businesses while implementing structural reforms in low-growth, low-profitability businesses.

Basic strategy 1Sustainable growth

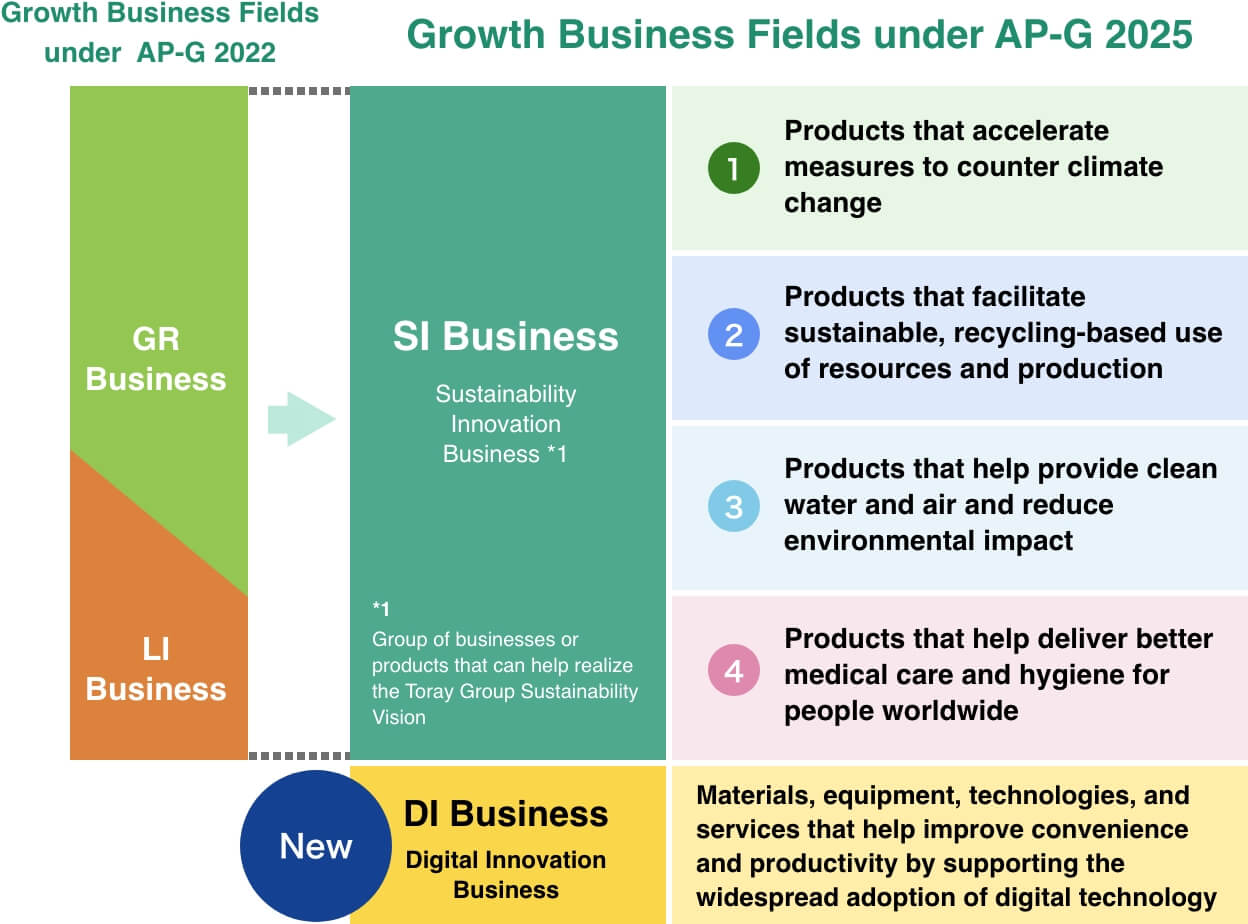

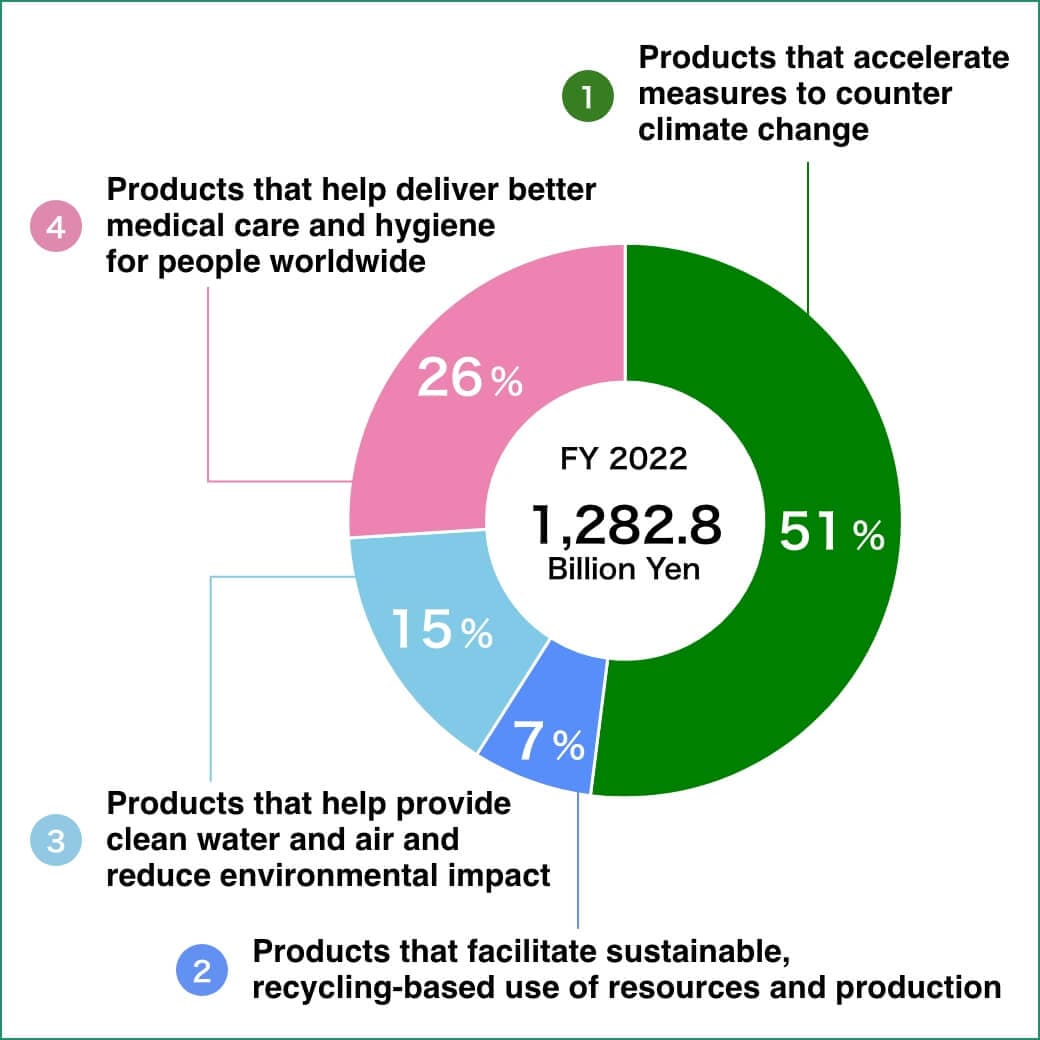

Based on the Toray Group Sustainability Vision, in AP-G 2025, we newly positioned the Sustainability Innovation (SI) Business, which we redefined a combination of Green Innovation (GR) businesses and Life Innovation (LI) businesses, and the Digital Innovation (DI) Business, which supports the realization of “Toray Group’s vision for the world,” as growth business fields for Toray Group.

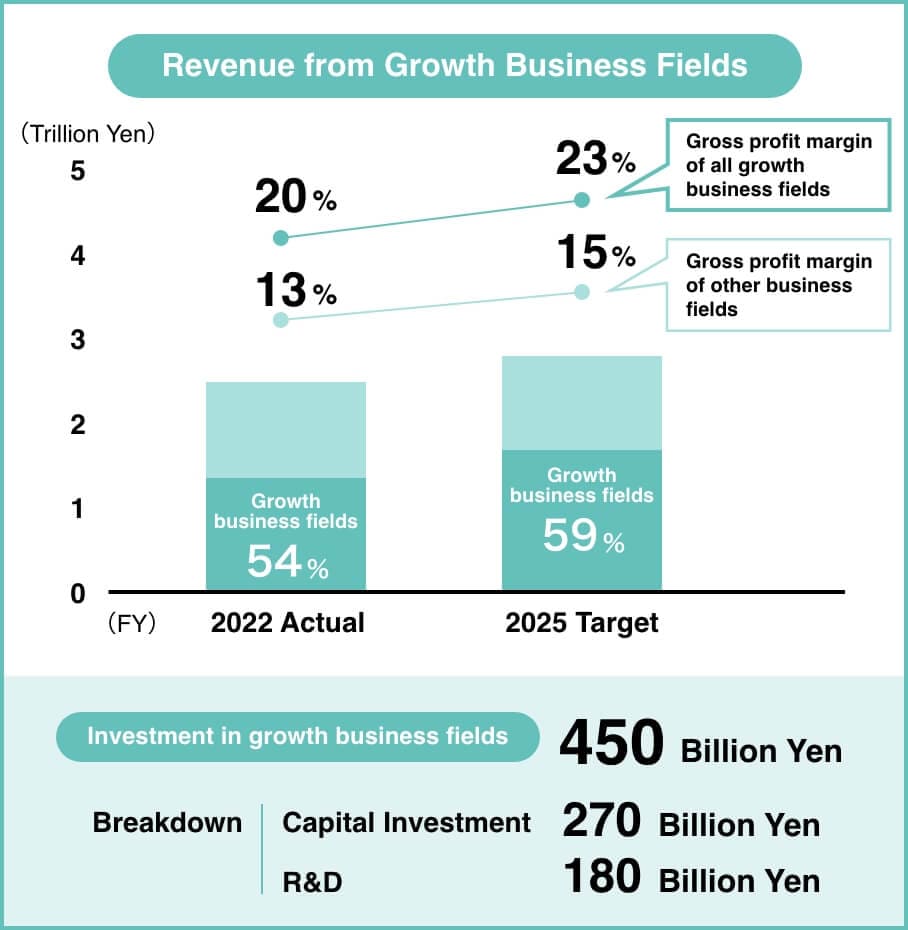

For these growth business fields, we plan to invest 450 billion yen in total including capital investment and R&D. In addition, we will establish a system for entire Group, provide comprehensive solutions to customers and accelerate cooperation with other companies. By taking these measures, growth business fields will account for about 60% of consolidated revenue.

Expansion of Sustainability Innovation (SI) Business

Main Business Fields of SI Business

1Products that accelerate measures to counter climate change

- Carbon fiber composite materials for aircrafts

- Materials for hydrogen and fuel cells

- Carbon fiber for wind turbine blades

- Carbon fiber for pressure vessels

2Products that facilitate sustainable, recycling-based use of resources and production

- Fiber & textile made from recycled PET bottles

- Recycled PET film

3Products that help provide clean water and air and reduce environmental impact

- Water treatment membranes

- Air filters

4Products that help deliver better medical care and hygiene for people worldwide

- Nonwoven fabrics for hygiene products

- Artificial kidney

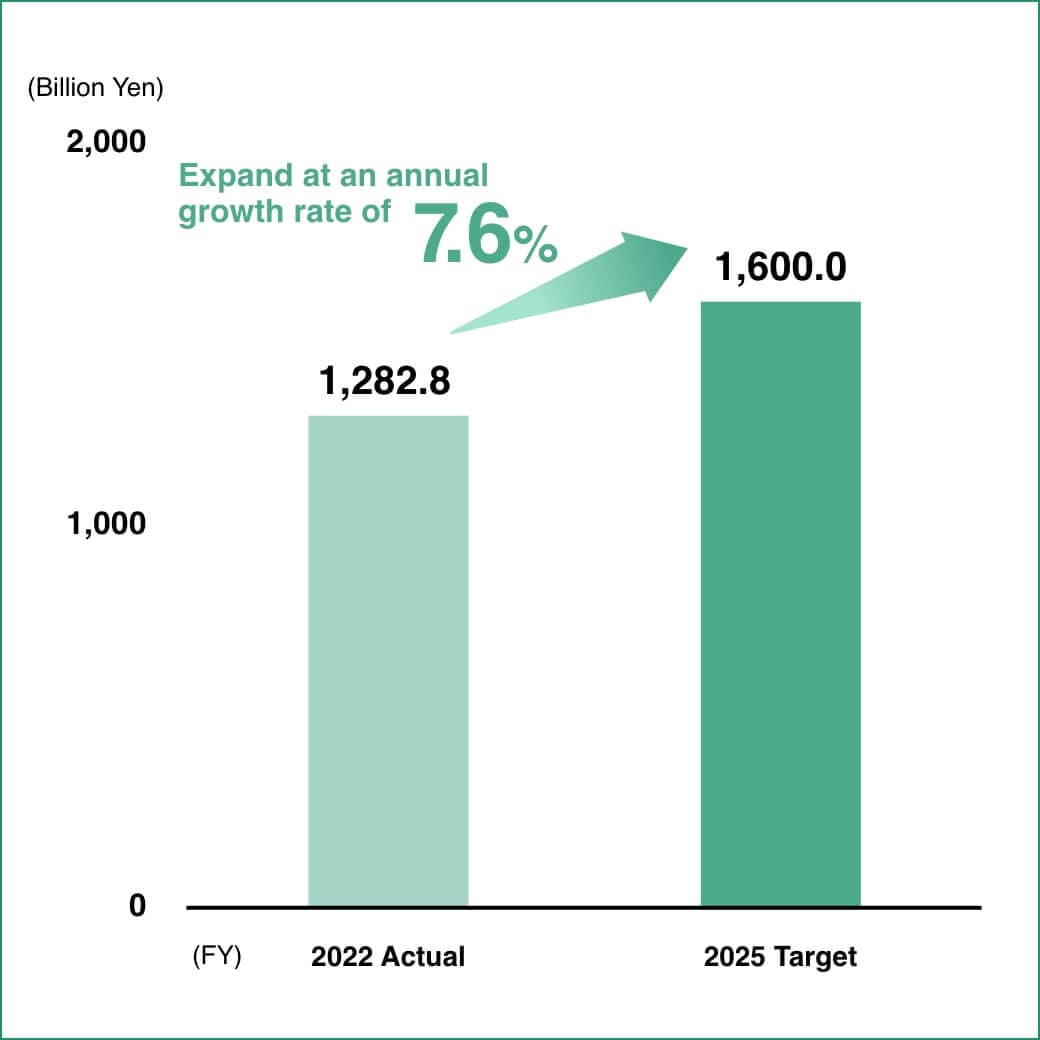

Sustainability Innovation (SI) Business

Revenue from of SI Business

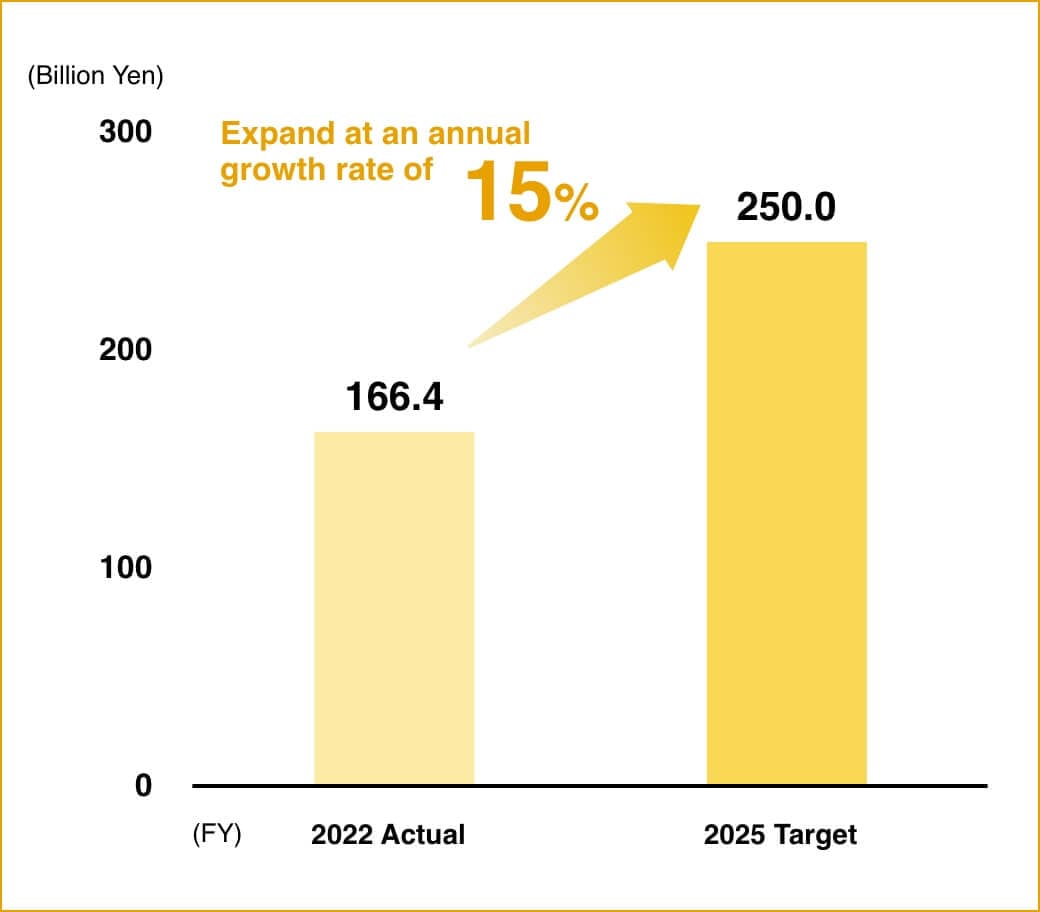

Expansion of Digital Innovasion (DI) Business

Main Business Fields of DI Business

- Electronic coating and mounting materials

- Flexible printed circuit boards

- Semiconductor manufacturing and inspection equipment

- Display materials

Revenue from DI Business

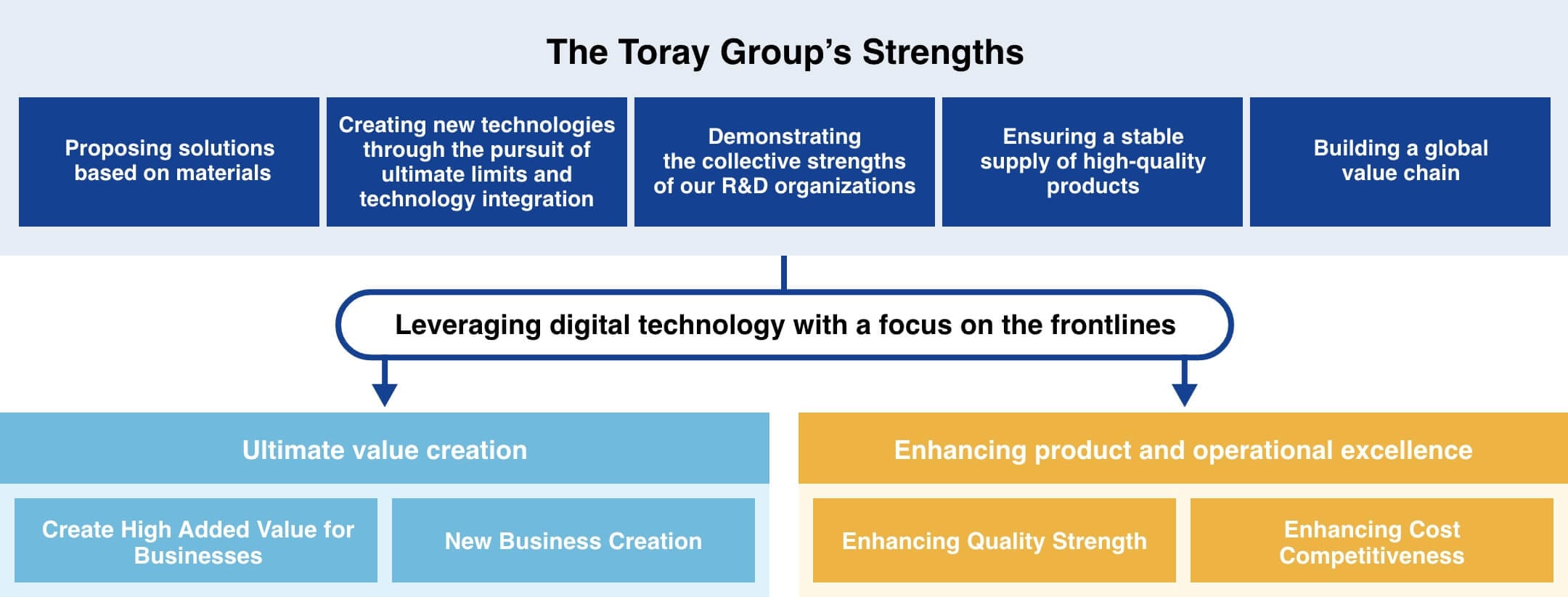

Basic strategy 2Ultimate value creation

Basic strategy 3Product and operational excellence

To seize new profit opportunites, based on the Toray Group's five strengths, we will work on enhancing our ability to create value and strengthening competitiveness, leveraging digital technology with a focus on the frontlines.

Ultimate value creation

Product and operational excellence

Basic strategy 4Enhancement of people-centric management

“People-centric management” is Toray’s corporate philosophy inherited since its foundation. We will enhance the Toray Group’s human resources base by respecting individual autonomy, enhancing expertise, and promoting career development.

Enhancement of people-centric management

Securing and promoting diverse human resources

- Actively appointing young core human resources

- Planned promotion of locally hired staff to management positions at group companies outside Japan

- Developing and providing career opportunities for highly specialized human resources

- Empowering women in the workforce and supporting their networking

- Providing opportunities for senior human resources

Human resources development

- Supporting self-reliant career development based on career path worksheets used by employees and their superiors

- Developing professional human resources by supporting employee self-development and empowering them to acquire abilities and skills

- Expanding opportunities such as internal recruitment, encouraging employees to take on new challenges

- Training leaders who can develop workplace competency

Promoting job satisfaction and supportive workplaces

- Creating workplaces environments and opportunities that lead to employee pride in working for the Toray Group

- Enabling work styles that accommodate employee life stages, along with career development

- Building an organizational culture that values feedback from the frontlines

Basic strategy 5Enhancing risk management and group governance

Achieving sound organizational management by improving internal controls and management capabilities.

Enhancement of risk management and group governance

- Risk management

-

- Implementing risk management through a group-wide risk management system

- Enhancing the risk management system and response to national economic security needs

- Internal controls

-

- Ensuring the effectiveness of internal controls by improving the operation and quality audit systems

- Improving internal controls by promoting operation flow digitization

- Enhancing Toray Group management capabilities

-

- Enhancing management capabilities of group companies in each country and region

- Legal affairs and compliance

- Development of management human resources

- Financial risk management

- Internal controls

- Information security

- DX promotion

Maintaining and enhancing financial soundness

Expanding high-growth, high-profitability businesses by achieving both business growth and greater profitability.

Seizing profit opportunities and strengthening the financial foundation

In addition to aiming for business growth through implementing the growth strategies, we aim to improve asset efficiency through cash flow and ROIC management, and achieve both business growth and greater profitability.

Seizing Profit OpportunitiesGrowing core operating income

- Expanding businesses in growth fields(SI/DI businesses)

- Improving profitability through value creation Improving reliable return on investment

- Investing necessary management resources to achieve targets

- Promoting M&A in areas where synergies can be expected

Strengthening the Management FoundationEfficient management of invested capital

- Using a D/E ratio guideline of 0.7 or lower

- Enhancing management of free cash flow

- Reducing working capital by maintaining Cash Conversion Cycle Improvement (3C-i) activities

- Enhancing structural reforms based on Four categories for growth potential and profitability

Four categories for growth potential and profitability

In addition to promoting business structure reform of low-growth and low-profitability businesses, we will work on expanding the high-growth high-profitability businesses as a Group-wide issue, and will allocate the necessary management resources flexibly in order to improve profitability.

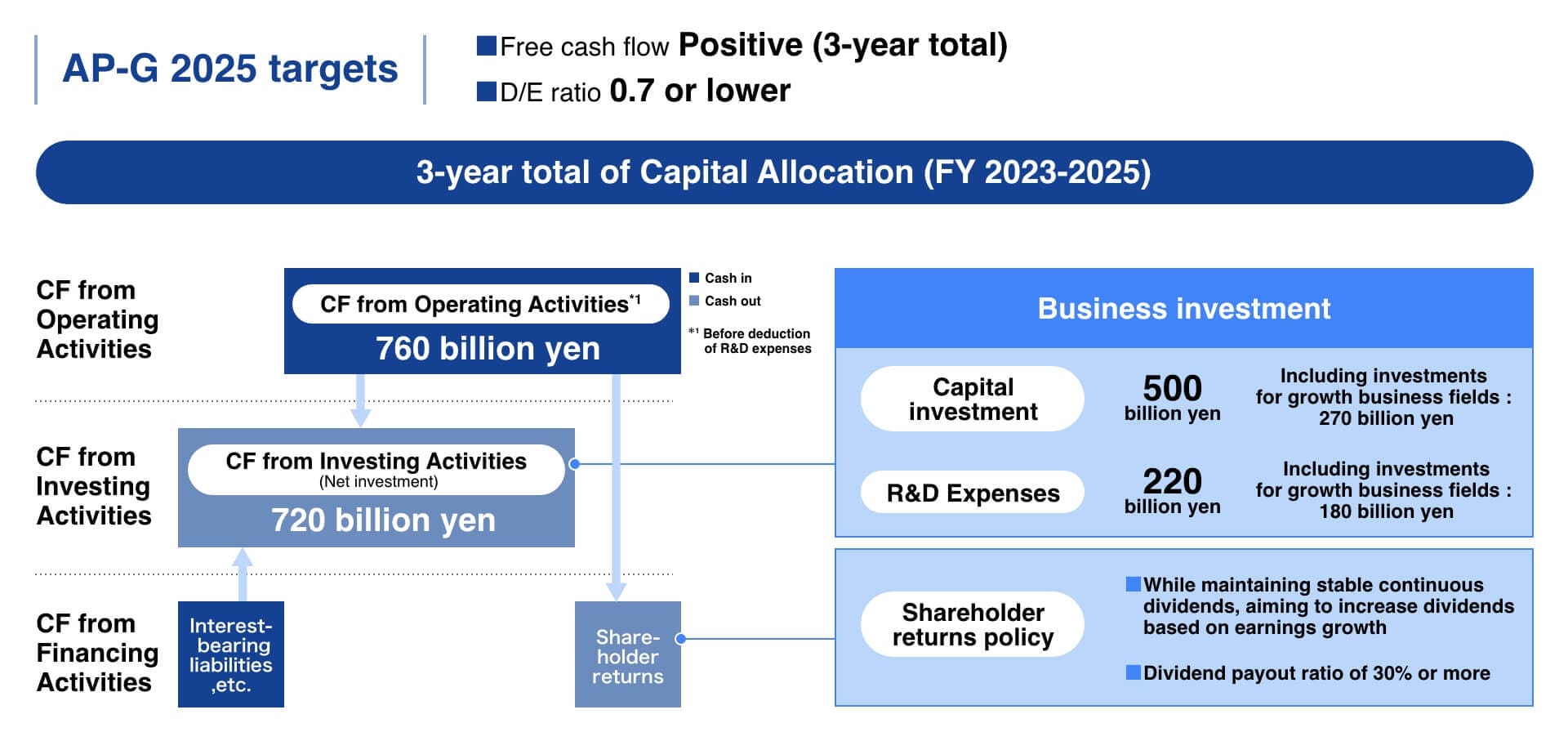

Capital allocation

The guideline for D/E ratio will be lowered from “around 0.8” to “0.7 or lower” to support sound, sustainable growth with a strong financial foundation. In addition, we will aim for positive three-year total cash flow.

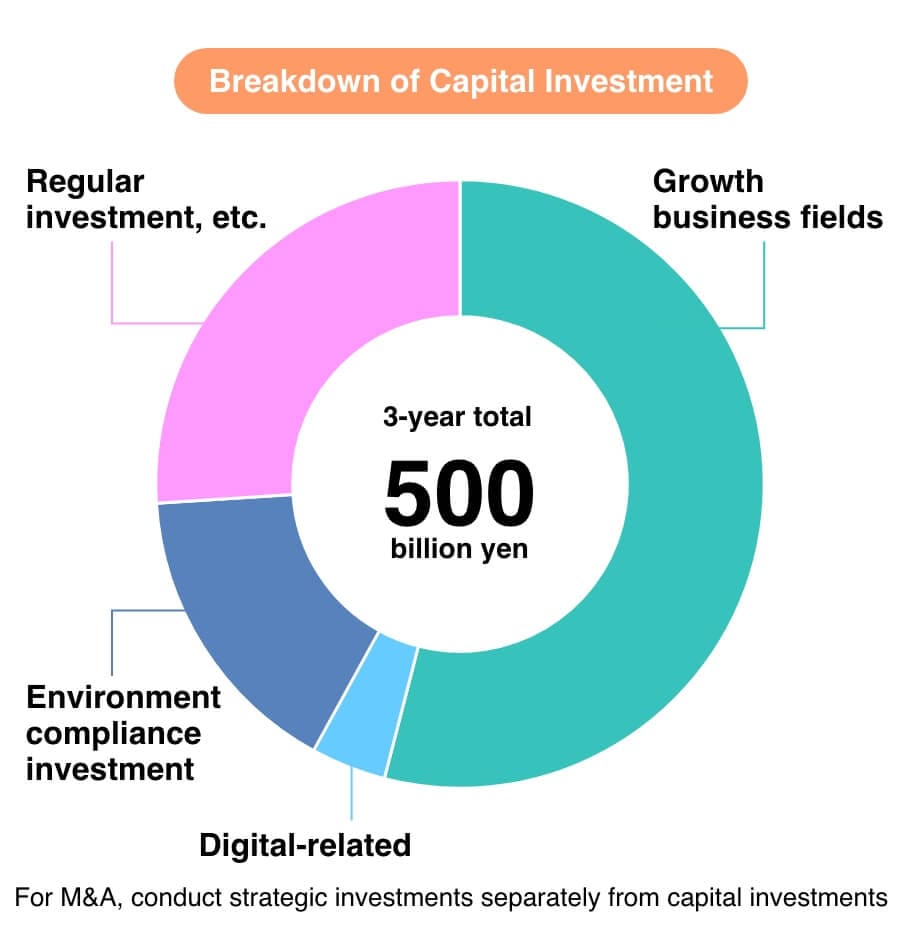

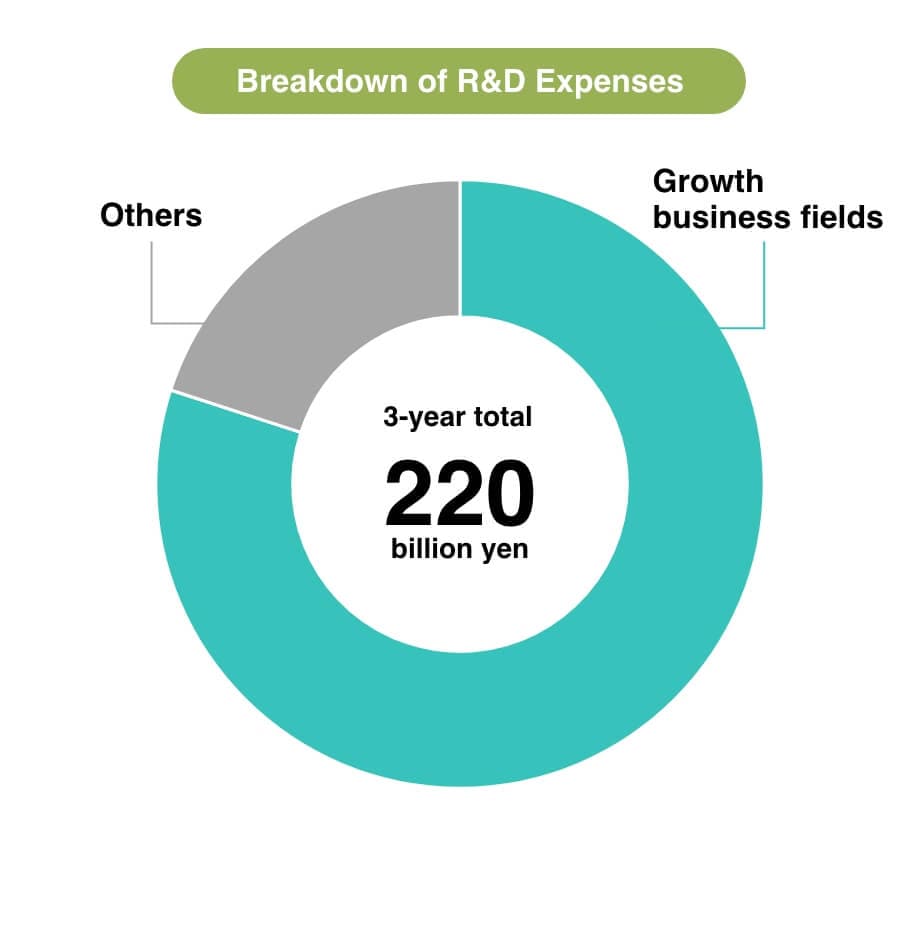

Capital investment and R&D expenses

KPIs for Fiscal 2025

1. Financial Targets

| FY 2022 Actual | FY 2025 Target | |

|---|---|---|

| Revenue | 2,489.3 billion yen | 2,800.0 billion yen |

| Core operating income | 96.0 billion yen | 180.0 billion yen |

| Core operating margin | 3.9% | 6% |

| ROIC*1 | 2.7% | About 5% |

| ROE*2 | 5.0% | About 8% |

| Free cash flow | 237.3 billion yen (3-year cumulative total) |

Positive (3-year cumulative total) |

| D/E ratio | 0.62 | 0.7 or lower (guideline) |

Exchange rate assumption for AP-G 2025: 125 yen per US dollar

*1. ROIC = Core operating income after tax / Invested capital (average of the balances at beginning and end of the period)

*2. ROE = Net profit attributable to owners of parent / Average equity attributable to owners of parent

2. Sustainability Targets

| FY 2013 Actual (Baseline) (J-GAAP) |

FY 2022 Actual (IFRS) |

FY 2025 Target (IFRS) |

|

|---|---|---|---|

| Revenue from Sustainability Innovation (SI) Business | 562.4 billion yen | 1,282.8 billion yen (2.3-fold) |

1,600.0 billion yen (2.8-fold) |

| CO2 emissions avoided in value chain | 38 million tons | 9.5-fold | 15.0-fold |

| Water filtration throughput contribution by Toray’s water treatment membranes | 27.23 million tons/day | 2.5-fold | 2.9-fold |

| Greenhouse gas emissions per unit of revenue in production activities | 337 tons/100 million yen | 35% reduction*1 | 40% reduction |

| Greenhouse gas emissions of Toray Group in Japan | 2.45 million tons | 21% reduction*1 | 20% reduction |

| Water usage per unit of revenue in production activities | 15,200 tons/100 million yen | 32% reduction*1 | 40% reduction |

*1. The calculation of the figure for the baseline of FY 2013 includes data for companies that joined the Toray Group in FY 2014 or later.